All You Need to Know on How to Develop a Decentralized Exchange

The DeFi landscape is booming, with the total value locked (TVL) in DeFi protocols surpassing $103 billion as of April 2024. At the heart of this growth lie decentralized exchanges (DEXs).

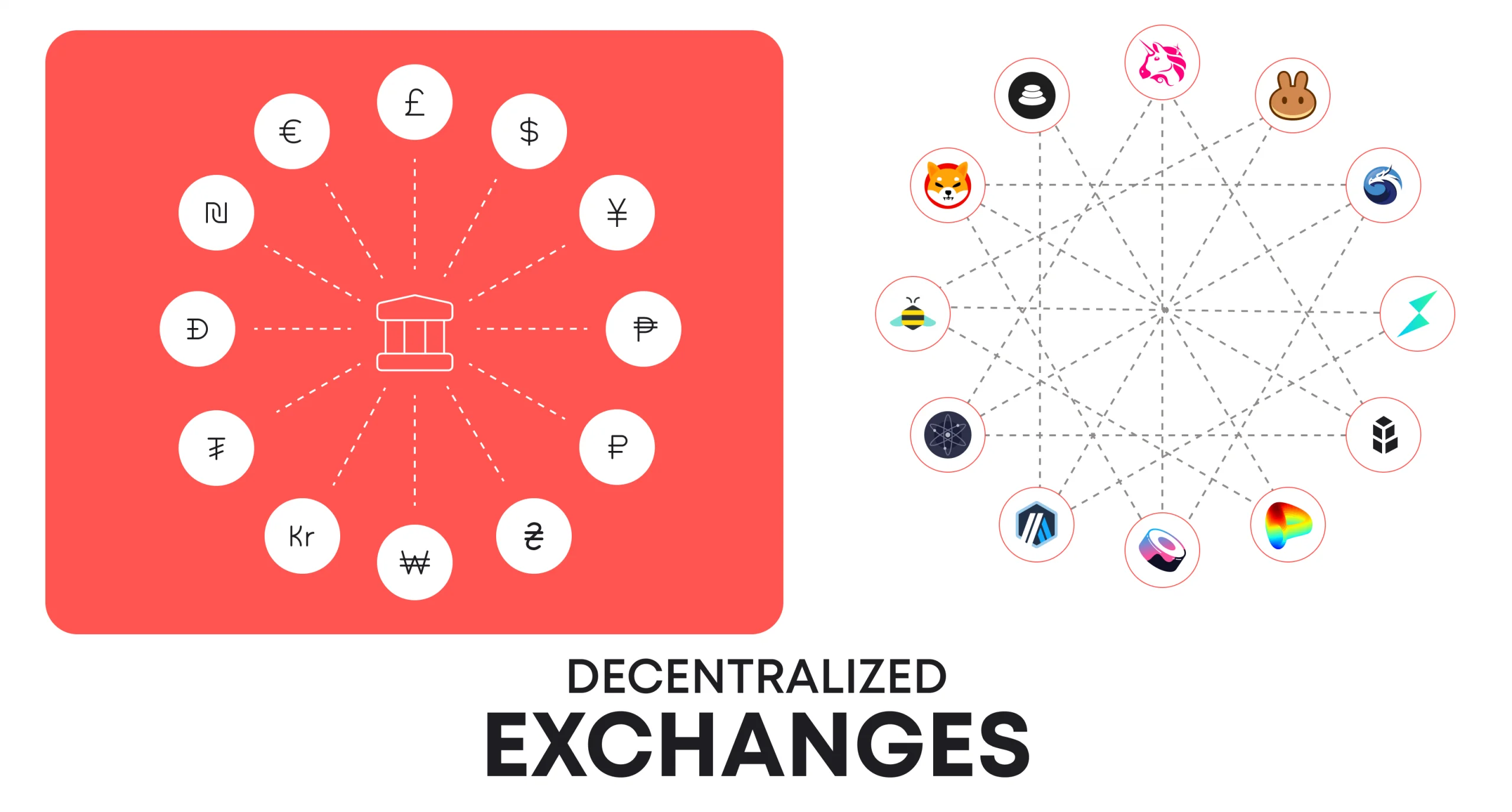

Decentralized exchanges revolutionize the trading landscape by utilizing blockchain technology to implement direct asset exchanges within a distributed ledger framework.

This innovative approach ensures users maintain complete control of their funds – a prevalent concern with centralized counterparts. Moreover, the transparency of DEXs, where each transaction is indelibly recorded on the blockchain and made verifiable to the public, raises a level of trust and fairness in traditional trading environments.

For entrepreneurs and innovators, the movement toward decentralized exchange development is a call to lead in the establishment of financial platforms that transcend trading tools to become cornerstones of a new financial paradigm.

Crafting a modern DEX is a complex venture that demands sophisticated knowledge of blockchain technology, smart contract development, liquidity management, and user interface design. At the same time, multidisciplined teams like Blaize know how to handle such tasks.

This guide is created to outline the steps involved in building a secure, user-friendly, and groundbreaking DEX in a detailed way. Enjoy!

What is a Decentralized Crypto Exchange?

A DEX is a platform that enables the direct trading of a wide range of assets, including cryptocurrencies, tokens, and derivatives, without the oversight of a central authority. These platforms are built on blockchain technology, which underpins their core characteristics of transparency, security, and privacy. By operating on a decentralized network, DEXs allow for a trustless exchange environment where users retain complete control over their assets and trading decisions.

The operational framework of a DEX diverges significantly from that of its centralized counterparts.

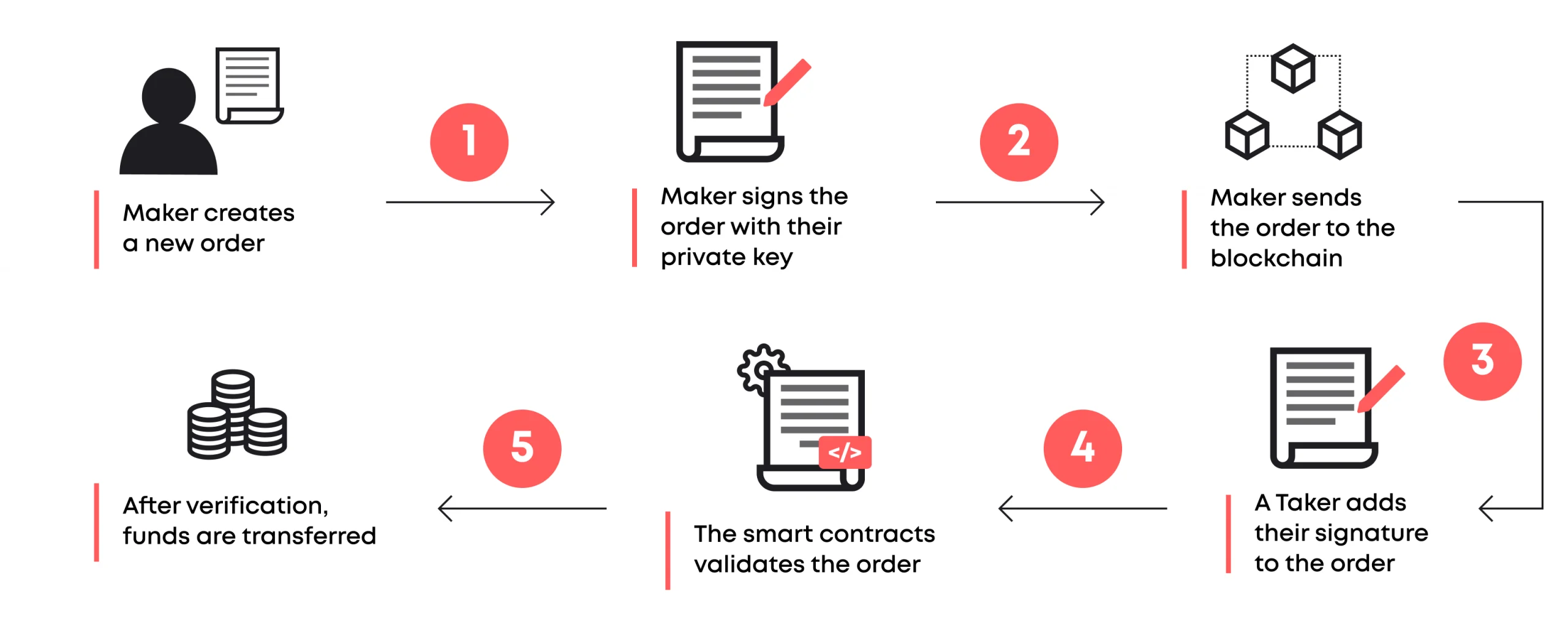

Instead of relying on an entity to hold and manage users’ funds, a DEX operates on a peer-to-contract basis, where trades are executed directly between users’ wallets and smart contracts.

This setup ensures that transactions are handled via the blockchain, with smart contracts automating the process and recording it transparently, rather than transactions occurring directly between wallets. These self-executing contracts with predefined rules automate the trade process, from order matching to settlement, ensuring that the exchange operates in a decentralized manner.

The decentralized nature of these platforms means that users retain full custody of their private keys and, by extension, their assets, throughout the trading process.

Key Components of a DEX include:

- Smart Contracts: The cornerstone of any DEX, smart contracts automate trading, liquidity provision, and settlement processes. They execute the terms of a trade without the need for intermediaries, based on the code written into the contract.

- Blockchain Infrastructure: The blockchain serves as the foundational layer for a DEX, providing a secure and transparent record of all transactions. This immutable ledger ensures the integrity and verifiability of each trade executed on the platform.

- User Interface: Despite the underlying complexity, DEXs strive to offer user-friendly interfaces that facilitate easy navigation and trading. The UI connects to users’ blockchain wallets, allowing them to perform trades, add or remove liquidity, and manage their assets directly on the platform.

- Oracles: Oracles play a crucial role in DEXs by providing real-time external data necessary for executing trades based on current market conditions. They act as bridges between off-chain data sources and the blockchain, ensuring that the DEX operates with accurate and timely information for pricing assets, executing smart contracts based on external triggers, and more. This is especially vital in platforms incorporating financial instruments like derivatives, where price accuracy is essential.

The DEX ecosystem encompasses a variety of exchange models, each with unique characteristics:

| Type | Description | Key Components | Examples |

| Traditional AMMs | Built around classic Automated Market Maker (AMM) curves, utilizing liquidity pools. Simple and efficient, but can suffer from high slippage and price impacts. | Liquidity pools | UniswapV2, SushiSwap, PancakeSwap |

| Alternative Curves and Multi-Coin Pools | Represents a second generation of AMMs, featuring a broader spectrum of instruments and mathematical models under the protocol. | Enhanced AMM curves, Multi-coin support | Balancer, Curve |

| Concentrated Liquidity | Modern evolution of AMM-based DEXes that address the slippage problem, allowing for advanced concepts such as limit orders. | Concentrated liquidity pools | UniswapV3, TraderJoe |

| Spot Trading / Limit Orders | Evolved from the simple order book model, these modern exchanges offer an extended set of trading instruments and can handle derivatives. Requires a matching engine. | Order book, Matching engine | GMX, RageTrade, 1inch limit orders, Pangolin |

| Trading Combines | Further evolution in asset exchange; some protocols utilize the dApp-chain concept to decentralize both core logic and the matching engine. | Own blockchain, Matching engine, Bridge to it | dYdX, Hyperliquid |

| Crosschain Exchanges | Focus on facilitating transactions across different blockchains, requiring additional infrastructure components such as workers and services to trigger contracts. | Crosschain workers, Multi-chain contract triggers | LayerZero, SushiXSwap |

By leveraging blockchain technology, smart contracts, and novel liquidity solutions, DEXs offer a secure, transparent, and user-empowered platform for trading digital assets. As these platforms continue to evolve, they promise to play a central role in the broader adoption and maturation of DeFi.

Advantages of Developing Your Own DEX

The development of a decentralized exchange represents a strategic venture into the heart of the DeFi ecosystem. This initiative aligns with the step towards autonomy and transparency in digital asset trading and offers plenty of specific advantages that are instrumental for entities looking to solidify their presence in the blockchain domain. Herein, we detail the multifaceted benefits of DEX development, emphasizing its potential to revolutionize the way we perceive and engage with financial services.

One of the paramount advantages of a DEX is the elevated level of security afforded by its decentralized nature. Unlike centralized exchanges (CEXs), where users should trust the platform to hold their funds, a DEX ensures that users retain full custody of their digital assets, mitigating the risks associated with fraudulent activities. The reliance on blockchain technology and smart contracts for transaction execution further reinforces this security framework, as it eliminates a single point of failure and provides a transparent audit trail. Even more – modern DEX solutions bring the CEX experience of speed and bandwidth (one of the successful examples is dYdX).

The immutable record of transactions, afforded by the blockchain infrastructure of a DEX, guarantees an unparalleled level of transparency in trading activities. Every transaction is verifiably recorded on the blockchain, fostering a trustless environment where trades can be executed without the necessity for intermediaries.

Developing a DEX opens up global market access, breaking down geographical and financial barriers to entry for users worldwide. This accessibility democratizes finance, allowing anyone with an internet connection to participate in the trading of digital assets without the need for traditional banking infrastructure.

Starting DEX development provides the unique opportunity to tailor the platform to specific needs and market niches. From customizing liquidity solutions to integrating innovative DeFi services, developers can create a distinctive ecosystem that addresses the demands of their target audience. This flexibility differentiates the DEX from competitors and accelerates the adoption of new technologies and trading strategies within the DeFi space.

By developing a DEX, entities contribute to the expansion and maturation of the DeFi ecosystem. A DEX serves as a foundational component in the broader landscape of decentralized applications (dApps), enabling seamless asset exchange and interoperability between different platforms and services. This interoperability is key to building a cohesive and efficient DeFi ecosystem, where users can leverage a full spectrum of financial services in a decentralized and secure manner.

The development of a decentralized exchange is not merely a technical endeavor but a strategic investment in the future of finance. It promises enhanced security, global accessibility, and the opportunity for innovation and revenue generation. As the DeFi landscape continues to evolve, the role of DEXs in shaping a decentralized, transparent, and inclusive financial system becomes increasingly essential.

Step-by-Step Guide to Building a DEX

Building a decentralized exchange is a multi-faceted and demanding task. It requires a deep understanding of blockchain technology, smart contract development, and security best practices. However, with careful planning, meticulous execution, and the right tools, you can navigate this process and launch a successful DEX. Blaize, a comprehensive suite of blockchain development solutions, can be your valuable partner throughout this journey.

1. Planning and Design: Charting Your DEX’s Course

- Model and Concept Definition: At the heart of every successful DEX lies a clear and differentiated model and concept. Blaize can assist you in brainstorming unique features and functionalities that will set your exchange apart. Will it cater to a specific token type or industry, or offer a broad spectrum of trading options?

- Security Audits: Prioritizing Trust and Safety Security is paramount in the decentralized world. Blaize can connect you with reputable blockchain security firms to conduct thorough audits of your smart contracts before deployment. This instills trust in users and minimizes potential vulnerabilities.

- User-Centric Design: An intuitive and user-friendly interface is essential for a positive user experience. Blaize can offer guidance on UI/UX best practices to ensure your DEX is easy to navigate and facilitates seamless trading experiences.

2. Development: Building the Core of Your DEX

- Smart Contract Development with Blaize: Smart contracts are the backbone of any DEX, handling token swaps, managing liquidity pools, and enforcing trading rules. Blaize offers a secure and well-tested smart contract development environment built on established frameworks like Solidity. This empowers you to create robust and reliable smart contracts that form the foundation of your DEX.

- Front-End Development for a Seamless User Journey: The user interface is how users interact with your DEX. Blaize can assist you in utilizing popular front-end development libraries like React or Vue.js to build a responsive and intuitive web interface that seamlessly connects to the smart contract layer.

- Wallet Integration: Enabling Frictionless Transactions For users to trade on your DEX, they need to connect their crypto wallets. Blaize facilitates integration with popular wallet solutions like MetaMask or WalletConnect, ensuring a smooth and familiar experience for users when depositing, withdrawing, and swapping tokens.

- Liquidity Incentives: Attracting Liquidity Providers Liquidity is the lifeblood of a DEX. Blaize can help you design and implement effective liquidity incentives, such as liquidity pools with attractive rewards. This encourages users to deposit their tokens and fosters a healthy trading environment.

3. Testing and Deployment: Ensuring a Secure and Robust Launch

- Rigorous Testing with Blaize’s Support: Before unleashing your DEX to the world, rigorous testing is crucial. Blaize can provide support in implementing automated and manual testing methodologies to ensure all functionalities, including smart contract logic, front-end interactions, and security measures, operate flawlessly.

- Deployment on a Blockchain Platform: Choosing the right blockchain platform for deployment is vital. Blaize offers guidance on popular options like Ethereum, Avalanche, or Solana (or 25+ more) considering factors like transaction fees, scalability, and security to find the best fit for your DEX.

4. Launch and Maintenance: Creating a Thriving DEX

- Liquidity Seeding: To bootstrap smooth trading activity, initial liquidity is essential. Blaize can assist you in developing strategies for seeding liquidity and attracting liquidity providers to your DEX.

- Marketing and Community Building: Raising awareness about your DEX’s features and benefits is key to attracting users. Blaize can offer guidance on effective marketing strategies and community-building techniques to create a thriving ecosystem around your DEX.

- Ongoing Maintenance and Security: The blockchain landscape is constantly evolving. Blaize can be your partner in continuously monitoring your DEX for vulnerabilities and potential exploits. This includes regular updates to smart contracts and front-end code to address any issues and implement new features, ensuring your DEX remains secure and competitive over time.

Building a DEX is a complex endeavor, but with Blaize by your side, you can navigate the challenges and achieve success. Blaize provides the tools, expertise, and support you need throughout the entire process, from initial concept to ongoing maintenance.

How Blaize Can Help with DEX Development

Blaize specializes in blockchain development services, including DEX development. With a team of experienced blockchain developers and consultants, Blaize can assist you through every step of the decentralized exchange development process. From conceptual design to deployment and beyond, Blaize provides expert guidance on smart contract development, security audits, UI/UX design, and technical support, ensuring your DEX is built to the highest standards.

The company’s portfolio showcases a series of collaborations that have significantly elevated the functionality, efficiency, and user engagement of various DEX projects. Here, we highlight Blaize’s notable contributions to the DeFi space, underscoring their expertise and the impact of their work.

Elevating StarkDefi’s DEX User Experience

In a notable project with StarkDefi, Blaize was tasked with refining the DEX’s user experience, a critical aspect of any digital platform’s success. The team focused on implementing complex functionalities such as swap point calculations and leaderboard management. These enhancements not only optimized the platform’s operational efficiency but also significantly boosted user engagement, making the trading experience more intuitive and rewarding for users.

Implementing Limit Orders in the NEAR Ecosystem

Blaize specialists undertook the challenge of integrating limit orders with zero swap fees on ref.finance, a core decentralized exchange within the NEAR ecosystem. This implementation required a deep understanding of the underlying blockchain technology and a strategic approach to enhance the platform’s trading capabilities without imposing additional costs on users. By achieving this, Blaize significantly contributed to the platform’s appeal and functionality, encouraging more efficient and cost-effective trading practices among users.

Advancing Leverage Trading on OMOMO

Another testament to Blaize’s expertise is their development of a leverage trading feature for OMOMO, in collaboration with the OMOMO Lending borrowing protocol and ref.finance. This feature, designed to amplify trading capabilities and strategies for users, was also a part of Blaize’s participation in the METABUILD III Hackathon. The project not only involved the integration of complex trading functionalities but also required rigorous testing to ensure the innovation’s viability and effectiveness within the market.

Blaize’s contributions to these projects underscore their deep technical knowledge, innovative approach, and commitment to enhancing the DeFi ecosystem. Through the implementation of advanced features and the optimization of user experiences, Blaize continues to play a pivotal role in the evolution of decentralized finance, proving to be an invaluable partner for DEX development projects.

Challenges and Trends in the DEX Industry

The decentralized exchange industry, while burgeoning with potential, faces a constellation of challenges and is simultaneously driven by rapidly evolving trends that are shaping the future of DeFi. To gain a deeper understanding of this dynamic landscape, we sought the insights of Pavlo Horbonos, Blaize’s Head of Security, who offers a unique perspective on the current state and trajectory of the DEX market.

Security, in particular, is a domain of paramount importance, with DEX platforms frequently targeted by sophisticated threats. Pavlo emphasizes, “The sophistication of attacks on DEX platforms is increasing. It’s imperative for DEX developers to prioritize advanced security measures, careful choice and integration of modern oracles, conduct rigorous smart contract audits, and foster a proactive security culture to safeguard user assets.” This underscores the ongoing battle between DEX platforms and malicious actors, highlighting the importance of robust security frameworks.

Amid these challenges, several key trends are emerging that signal the direction of the DEX industry. One such trend is the rise of cross-chain DEX platforms, offering users the ability to trade across different blockchain ecosystems seamlessly. This addresses one of the longstanding limitations of DEXs – asset silos within single blockchains.

Another significant trend is the integration of advanced financial instruments and services, such as derivatives trading, and insurance products, directly into DEX platforms. These offerings not only enhance the utility of DEXs but also attract a broader range of users seeking comprehensive DeFi solutions.

Pavlo Horbonos adds, “The integration of AI and machine learning for pro-active protection, market analysis, and fraud detection represents a frontier for DEX innovation, offering the potential to drastically improve user experience and security.”.

Conclusion

The landscape of decentralized exchanges is one of profound opportunity, marked by the relentless pursuit of innovation to overcome inherent challenges.

As the market continues to evolve, the expertise and forward-thinking approach of companies like Blaize will be instrumental in navigating the complexities of the DEX industry. By leveraging advanced security practices, embracing emerging trends, and addressing the challenges head-on, the future of DEXs and, by extension, the broader DeFi ecosystem, is poised for significant growth and transformation.

FAQ

What is DEX and how does it work?

A Decentralized Exchange is a platform enabling users to exchange assets leveraging the power of blockchain technology and smart contracts. This setup ensures a trustless environment where transactions are executed without the need for intermediaries, enhancing transparency and security. DEXs facilitate a more open and accessible financial ecosystem, making them a cornerstone of the DeFi movement.

Why build your own DEX?

Developing your own DEX provides unparalleled control over the trading environment, offering enhanced security features and a user-centric approach to financial exchanges. It positions you to directly address the growing demand for DeFi services, allowing for the customization of features and functionalities that meet the specific needs of your user base. Furthermore, creating a DEX opens up revenue streams through transaction fees and services, supported by firms like Blaize.

How long does it take to develop a DEX?

The timeline for developing a DEX can range significantly, from a few months to over a year, contingent upon the project’s complexity, the features desired, and the level of customization required. Early planning and clear definition of the project scope can streamline the development process. Companies like Blaize offer expertise in blockchain technology, which can accelerate the development cycle by employing agile methodologies and providing access to pre-built modules and security frameworks.

What are the costs associated with DEX development?

The costs associated with developing a DEX are highly variable, depending on the scope of the project, the blockchain platform chosen, and the necessity of additional services such as security audits, marketing, and user interface design. Engaging with a development partner like Blaize can provide cost efficiencies through expert guidance, efficient use of resources, and access to an experienced team that understands the nuances of blockchain development and DeFi ecosystems.

Can a DEX be developed on any blockchain platform?

While it’s possible to develop a DEX on many blockchain platforms, choices like Ethereum, Avalanche, and Solana are popular due to their robust DeFi ecosystems, scalability solutions, and supportive community. The selection of a blockchain platform should consider factors such as transaction speed, cost, and the ease of integrating with other DeFi projects. Blaize’s expertise in a variety of blockchain technologies can assist in making the optimal choice for DEX development.

How do I ensure the security of my DEX?

Ensuring the security of a DEX involves multiple strategies, including rigorous smart contract audits, the establishment of bug bounty programs, and adherence to best security practices in the industry. Leveraging the expertise of blockchain security specialists like Blaize can significantly bolster the security posture of a DEX through thorough audits, penetration testing, and ongoing security monitoring to safeguard against emerging threats and vulnerabilities.