Web3 in Finance: A Detailed Overview

The financial landscape is undergoing a monumental transformation with the advent of Web3, a new era of the internet that emphasizes decentralization, transparency, and user empowerment. Unlike its predecessors, Web1, which was static and informational, and Web2, which brought interactivity and user-generated content, Web3 represents a paradigm shift by leveraging blockchain technology to create a more decentralized and democratized financial ecosystem.

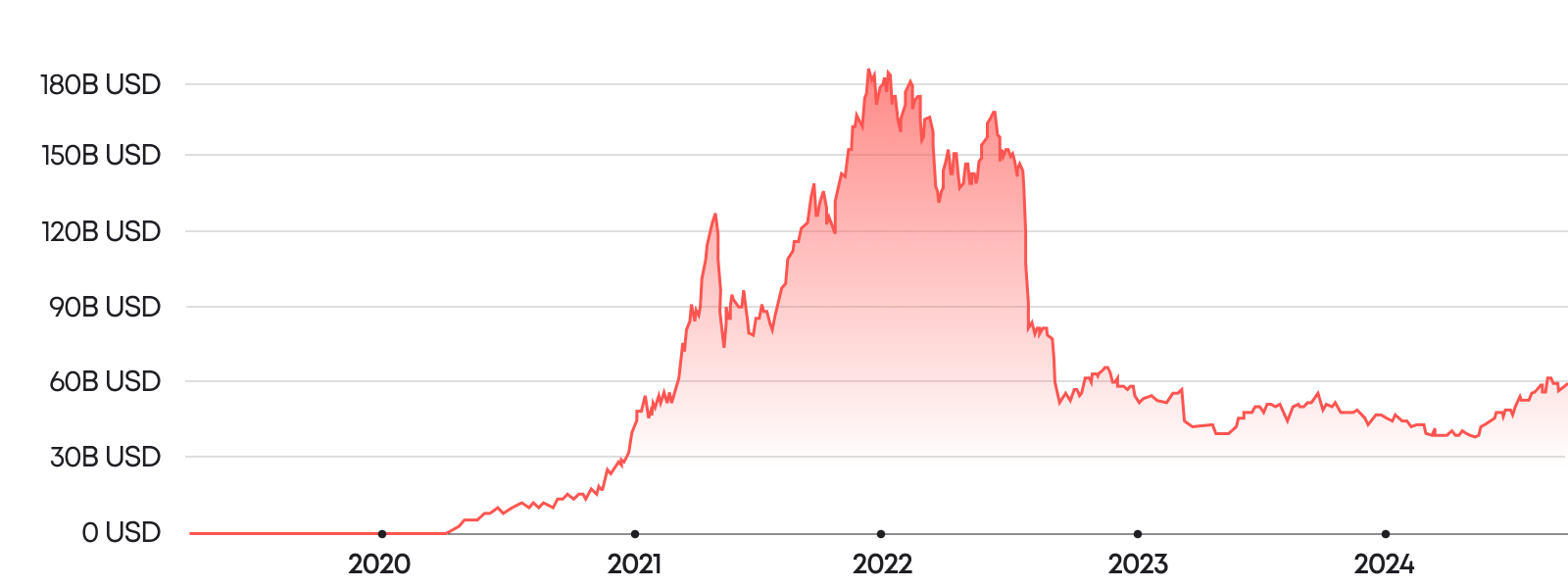

Web3’s impact on finance is profound, driven by the integration of cutting-edge technologies such as blockchain, smart contracts, and dApps. According to the data by DeFiLama, the decentralized finance sector has seen exponential growth, with the total value locked (TVL) in DeFi protocols reaching over $100 billion in 2024, up from just $300 million in early 2019. This rapid growth highlights the increasing adoption and trust in decentralized financial systems.

Web3’s transition from the centralized models of Web1 and Web2 to a decentralized framework offers numerous advantages. It eliminates the need for intermediaries, thereby reducing costs and increasing transaction speed. Additionally, Web3 enhances financial inclusivity by providing access to financial services to unbanked and underbanked populations globally. According to the World Bank, approximately 1.7 billion adults remain unbanked, and Web3 has the potential to bridge this gap by offering inclusive financial solutions.

In this article, we will delve into the key concepts and components of Web3 in finance, explore the various financial models within Web3, and discuss the benefits and challenges associated with this revolutionary approach. We will also examine the future potential of Web3 in transforming the global financial ecosystem, making it more inclusive, efficient, and transparent.

Key Concepts and Components of Web3 in Finance

The foundation of Web3 in finance is built upon three crucial elements: decentralization, blockchain technology, and smart contracts. These components work together to create a secure, transparent, and efficient financial ecosystem. Understanding these elements is essential to grasping the transformative potential of Web3 in the financial sector.

Decentralization

At the core of Web3 is decentralization, a fundamental shift from the centralized control of data and services to a distributed network. This paradigm shift redistributes power from centralized entities, such as banks and financial institutions, to individual users and communities. Decentralization eliminates single points of failure, making the financial system more resilient and secure. By allowing peer-to-peer transactions and interactions, Web3 ensures that control and ownership are truly in the hands of the users, fostering greater trust and transparency in financial operations.

Blockchain Technology

Blockchain technology is the backbone of Web3, providing a secure, immutable ledger for recording transactions. This distributed ledger technology ensures that all participants in the network have access to a single source of truth, enhancing transparency and reducing the risk of fraud. Each transaction is cryptographically secured and linked to the previous one, creating an unalterable chain of records. Blockchain’s decentralized nature also means that there is no central point of control or failure, making it inherently more secure against hacking and data breaches.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce and execute agreements when predefined conditions are met, removing the need for intermediaries and reducing the potential for human error or manipulation. In the context of finance, smart contracts enable the automation of complex financial transactions and processes, from lending and borrowing to insurance and asset management. By ensuring that transactions are executed exactly as programmed, smart contracts enhance security, efficiency, and trust.

Financial Models in Web3

The advent of Web3 has introduced new financial models that redefine how financial services are delivered and consumed. These models encompass traditional finance (TradFi), centralized finance (CeFi), and decentralized finance (DeFi). Each model offers unique characteristics and benefits, contributing to the evolving financial landscape.

Traditional Finance:

TradFi operates through established financial institutions such as banks, credit unions, and brokerage firms. These institutions provide a wide range of services, including savings and checking accounts, loans, mortgages, and investment products.

Limitations:

- Centralization: Control is centralized, creating single points of failure and potential systemic risks.

- High Costs: Services often come with high fees due to the involvement of multiple intermediaries.

- Limited Access: Access to financial services can be restricted by geographical, regulatory, and socioeconomic barriers.

- Slow Processes: Traditional systems often involve lengthy processes and paperwork, leading to inefficiencies and delays.

Centralized Finance:

CeFi bridges the gap between traditional finance and decentralized finance. CeFi platforms leverage blockchain technology while maintaining some level of centralization to provide more familiar and regulated financial services. The key benefits include:

- User-Friendly Interfaces: CeFi platforms offer intuitive interfaces that make it easier for users to interact with digital assets.

- Regulatory Compliance: These platforms typically comply with regulatory requirements, providing a sense of security and trust for users.

- Liquidity: CeFi platforms often have higher liquidity due to their centralized nature and integration with traditional financial systems.

Limitations:

- Centralization Risks: While offering some decentralization benefits, CeFi still relies on centralized control, which can pose risks similar to TradFi.

- Custodial Nature: Users often have to trust the platform with their assets, which can lead to security and trust issues.

Decentralized Finance

DeFi represents the most transformative model within Web3, utilizing blockchain technology and smart contracts to offer financial services without intermediaries. The core benefits include:

- Permissionless Access: Anyone with an internet connection can access DeFi services, promoting financial inclusivity.

- Non-Custodial Services: Users retain full control of their assets, reducing reliance on third parties.

- Transparency: All transactions are recorded on public blockchains, enhancing transparency and trust.

- Innovation: DeFi fosters rapid innovation in financial products and services, from lending and borrowing to complex derivatives and decentralized exchanges.

- Disintermediation: DeFi removes intermediaries, reducing costs and increasing transaction speed.

- Empowerment: Users have greater control over their financial activities and data.

- Global Reach: DeFi enables cross-border transactions without the need for traditional financial infrastructure.

Limitations:

- Scalability Issues: Current blockchain networks face challenges in handling large transaction volumes efficiently.

- Security Concerns: While generally secure, DeFi platforms can be vulnerable to smart contract bugs and hacks.

- Regulatory Uncertainty: The rapidly evolving regulatory landscape poses challenges for DeFi platforms, which must navigate complex legal requirements.

Read More: Blaize sophisticated DeFi protocols development services.

Embracing DeFi

DeFi is a revolutionary component of Web3, redefining the traditional financial landscape through its core principles of transparency, user empowerment, and financial inclusivity. By leveraging blockchain technology and smart contracts, DeFi offers an open, permissionless financial ecosystem that provides unprecedented opportunities and benefits.

Transparency

DeFi platforms operate on public blockchains, where all transactions are recorded on immutable ledgers. This level of transparency allows anyone to audit and verify transactions, reducing the risk of fraud and corruption. The transparency inherent in DeFi fosters a higher level of trust among users, as they can independently verify the integrity and security of the financial operations.

With transparent operations, DeFi platforms ensure that all actions are visible and accountable. This openness reduces the need for blind trust in centralized institutions and intermediaries. Users can track the flow of funds, monitor smart contract executions, and audit the overall system’s health, leading to a more trustworthy financial environment.

User Empowerment

DeFi empowers users by giving them full control over their financial assets. Unlike traditional financial systems, where banks and intermediaries manage and control user funds, DeFi platforms enable individuals to manage their own assets directly. This self-custody model eliminates the need for third-party control and significantly reduces the risk of asset seizure or mismanagement.

In the DeFi ecosystem, decision-making is often decentralized through mechanisms such as DAOs. DAOs allow users to participate in governance and decision-making processes, giving them a voice in the development and operation of the platforms they use. This democratic approach aligns the interests of the platform with its user community, fostering greater engagement and satisfaction.

Financial Inclusivity

DeFi has the potential to democratize access to financial services, especially for those underserved by traditional financial systems. With just an internet connection, individuals from any part of the world can access DeFi services, bypassing geographical, regulatory, and socioeconomic barriers that typically hinder access to banking and financial services.

DeFi platforms offer a wide array of financial products that are accessible to anyone. These include decentralized lending and borrowing, where users can obtain loans without traditional credit checks or collateral requirements. Similarly, DEXs provide platforms for trading digital assets without the need for centralized intermediaries. This inclusivity fosters financial innovation and creates opportunities for wealth generation and economic participation.

By eliminating intermediaries and automating processes through smart contracts, DeFi reduces transaction costs and fees. This cost efficiency makes financial services more affordable and accessible, particularly benefiting those with limited financial resources. The lower barriers to entry and reduced costs enhance financial participation and inclusion on a global scale.

Key Features of DeFi

DeFi is characterized by a range of innovative features that distinguish it from traditional financial systems. These features leverage blockchain technology and smart contracts to create a transparent, secure, and inclusive financial ecosystem. Here are the key features of DeFi:

Lending and Borrowing

DeFi platforms facilitate peer-to-peer lending and borrowing without the need for traditional financial intermediaries. By using smart contracts, these platforms automate the lending process, offering competitive interest rates and eliminating the need for credit checks. Borrowers can access funds by providing collateral in the form of digital assets, while lenders earn interest on their deposits.

Example: Aave is a leading DeFi protocol that allows users to lend and borrow a wide range of cryptocurrencies. It offers features like flash loans and interest rate switching, enhancing flexibility and user control.

Stablecoins

Stablecoins are digital assets pegged to a stable asset, such as a fiat currency (e.g., USD) or a commodity (e.g., gold). They provide stability in the volatile cryptocurrency market, enabling users to transact and store value without worrying about price fluctuations. Stablecoins are essential for DeFi as they facilitate transactions, lending, and borrowing while maintaining value stability.

Example: USDC (USD Coin) is a widely used stablecoin backed by the US dollar, providing stability and trust within the DeFi ecosystem. It is commonly used for trading, lending, and payments on various DeFi platforms.

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) enable users to trade digital assets directly from their wallets, enhancing security and control. Unlike centralized exchanges, DEXs operate without intermediaries, reducing the risk of hacking and manipulation. They utilize automated market makers (AMMs) and liquidity pools to facilitate trading, ensuring efficient and transparent transactions.

Example: Uniswap is a prominent DEX that allows users to trade a wide variety of cryptocurrencies directly from their wallets. It uses AMMs to provide liquidity and execute trades, offering a decentralized and secure trading experience.

Explore all you wanted to know about DEX development by Blaize.

Derivatives

DeFi introduces innovative derivative products that allow users to hedge risks and engage in speculative trading. These financial instruments include options, futures, and swaps, providing advanced strategies for risk management and profit generation. DeFi derivatives platforms offer greater accessibility and transparency compared to traditional derivatives markets.

Example: Synthetix is a leading DeFi platform for synthetic assets, allowing users to trade derivatives that track the value of real-world assets. It provides a wide range of synthetic products, including commodities, fiat currencies, and cryptocurrencies.

Fund Management

DeFi platforms offer various fund management strategies, including automated investment services and decentralized hedge funds. Users can participate in passive investment opportunities through yield farming and liquidity mining or engage in active fund management by investing in DAOs and other collective investment vehicles.

Example: Yearn Finance is a DeFi protocol that optimizes yield farming strategies, allowing users to maximize returns on their cryptocurrency holdings through automated investment strategies.

Payments

DeFi enhances payment systems by providing fast, secure, and low-cost transactions. Blockchain-based payment solutions eliminate intermediaries, reducing transaction fees and processing times. DeFi payments are borderless, enabling global transactions without the need for traditional financial infrastructure.

Example: Flexa is a DeFi payment network that allows users to spend cryptocurrencies at various merchants worldwide. It offers instant, fee-free transactions, making it a practical solution for everyday payments.

Insurance

DeFi insurance platforms provide coverage for various risks, including smart contract failures, hacking incidents, and other vulnerabilities. These decentralized insurance solutions operate transparently and efficiently, offering policies underwritten by the community and governed by smart contracts.

Example: Nexus Mutual is a decentralized insurance protocol that provides coverage for smart contract risks. It allows users to purchase insurance policies and participate in the governance and underwriting process.

Decentralized Governance (DAOs)

Decentralized Autonomous Organizations enable community-driven governance of DeFi platforms. DAOs allow stakeholders to participate in decision-making processes, from protocol upgrades to fund allocation. This decentralized governance model ensures that the platform’s development and management align with the community’s interests.

Example: MakerDAO is a pioneering DAO that governs the Maker Protocol, which issues the DAI stablecoin. MKR token holders vote on proposals related to the protocol’s development, risk management, and overall governance.

| Feature | Description | Best Example |

| Lending and Borrowing | Peer-to-peer lending with smart contracts and collateralized loans. | Aave |

| Stablecoins | Digital assets pegged to stable assets, providing stability. | USDC |

| Decentralized Exchanges | Direct wallet-to-wallet trading without intermediaries. | Uniswap |

| Derivatives | Advanced financial instruments for risk management and speculation. | Synthetix |

| Fund Management | Automated and decentralized investment strategies. | Yearn Finance |

| Payments | Fast, secure, and low-cost blockchain-based transactions. | Flexa |

| Insurance | Coverage for risks through smart contract-based policies. | Nexus Mutual |

| Decentralized Governance | Community-driven decision-making and platform management. | MakerDAO |

Addressing Centralized Finance Shortcomings

DeFi addresses several critical shortcomings inherent in traditional CeFi. By leveraging blockchain technology and smart contracts, DeFi offers solutions that enhance access, efficiency, transparency, and trust, while reducing dependency on intermediaries.

Access and Efficiency

Bridging the Financial Inclusion Gap:

Centralized finance often excludes significant portions of the global population due to geographical, regulatory, and socioeconomic barriers. According to the World Bank, about 1.7 billion adults remain unbanked. DeFi platforms provide a solution by offering permissionless access to financial services, enabling anyone with an internet connection to participate in the financial ecosystem. This inclusivity is particularly impactful for individuals in developing regions who lack access to traditional banking services.

Improving Operational Efficiency:

Traditional financial systems are often bogged down by bureaucratic processes and intermediaries, leading to inefficiencies and delays. DeFi eliminates these intermediaries by automating processes through smart contracts. These self-executing contracts streamline operations, reducing the time and cost associated with transactions. For example, international remittances can be processed in minutes rather than days, and without the high fees typically charged by banks and money transfer services.

Transparency and Trust

Enhancing Financial Clarity:

One of the most significant advantages of DeFi is the transparency it brings to financial transactions. All activities on DeFi platforms are recorded on public blockchains, creating an immutable and auditable trail. This transparency ensures that users can verify transactions independently, reducing the potential for fraud and corruption. In contrast, centralized financial institutions often operate in opaque environments where information asymmetry can lead to mistrust and manipulation.

Building Trust through Openness:

DeFi platforms operate on open-source protocols, allowing anyone to inspect and verify the underlying code. This openness builds trust among users, as they can be assured that the platform’s operations are transparent and verifiable. Additionally, decentralized governance models, such as DAOs, enable community participation in decision-making processes, further enhancing trust and alignment with user interests.

Eliminating Intermediaries

Reducing Dependency on Traditional Financial Institutions:

Centralized finance relies heavily on intermediaries like banks, brokers, and payment processors to facilitate transactions. These intermediaries add layers of complexity, cost, and potential points of failure. DeFi removes these intermediaries by enabling direct peer-to-peer transactions. This disintermediation reduces transaction costs, increases speed, and enhances security by minimizing the number of entities handling user funds.

Empowering Users with Direct Control:

In the DeFi ecosystem, users maintain full control over their assets. Unlike centralized platforms where users must trust third parties to manage their funds, DeFi platforms enable self-custody. Users interact directly with smart contracts to execute transactions, reducing the risk of asset mismanagement or loss due to intermediary failure. This direct control is a fundamental shift towards a more user-centric financial system.

Challenges and Limitations

While DeFi holds immense potential, it also faces several significant challenges and limitations that need to be addressed for its broader adoption and sustainable growth. These include scalability issues, user experience, and regulatory compliance.

| Challenge | Description | Implications | Current Solutions |

| Scalability | The ability of blockchain networks to handle a large volume of transactions efficiently. | As DeFi platforms grow, blockchain networks like Ethereum face congestion, leading to slower transaction times and higher fees. This limits the usability and accessibility of DeFi services. | Layer 2 solutions (e.g., Optimistic Rollups, zk-Rollups), sharding, and the development of alternative blockchains like Polkadot and Solana. |

| User Experience (UX) | The ease with which users can interact with DeFi platforms. | DeFi platforms often have complex interfaces and require a high level of technical knowledge. This complexity can deter mainstream adoption and limit user engagement. | Developing more intuitive interfaces, offering better educational resources, and integrating with familiar platforms. |

| Regulatory Compliance | The ability to adhere to legal and regulatory requirements across different jurisdictions. | The regulatory landscape for DeFi is still evolving, with uncertainty around compliance, taxation, and legal obligations. This uncertainty can hinder growth and pose risks to users. | Engaging with regulators to develop clear guidelines, incorporating compliance measures into DeFi protocols, and creating self-regulatory organizations (SROs). |

| Security Concerns | The potential for vulnerabilities in smart contracts and platform protocols. | Security breaches and exploits can lead to significant financial losses for users, undermining trust in DeFi platforms. | Conducting regular security audits, utilizing formal verification methods, and implementing robust security protocols. |

| Liquidity | The availability of sufficient assets to facilitate trading and lending on DeFi platforms. | Limited liquidity can lead to high volatility and price slippage, affecting the stability and reliability of DeFi markets. | Incentivizing liquidity provision through yield farming, liquidity mining, and the integration of cross-chain liquidity solutions. |

By addressing these challenges and limitations, DeFi can pave the way for a more robust and user-friendly financial ecosystem. The ongoing efforts to enhance scalability, improve user experience, ensure regulatory compliance, bolster security, and increase liquidity are crucial for the sustainable development of decentralized finance.

Future of Web3 in Finance

Technological Advancements

Upcoming technological advancements in blockchain and decentralized technologies will further enhance the capabilities and efficiency of Web3 finance. Innovations in scalability, interoperability, and privacy will drive the next wave of growth.

Integration with Traditional Finance

Harmonizing Web3 with existing financial systems will create a more comprehensive and resilient financial ecosystem. Collaboration between traditional financial institutions and Web3 platforms will offer hybrid solutions that leverage the strengths of both models.

Global Financial Ecosystems

The long-term vision for Web3 in finance includes the creation of a global financial ecosystem that transcends borders and provides equitable access to financial services. This future includes the integration of digital identity solutions, enabling seamless and secure participation in the global economy.

Conclusion

DeFi represents a groundbreaking shift in the financial landscape, offering unparalleled opportunities for transparency, user empowerment, and financial inclusivity. By leveraging blockchain technology, smart contracts, and decentralized governance, DeFi provides a more open, efficient, and secure financial system. However, for DeFi to reach its full potential, several critical challenges must be addressed.

Scalability remains a primary concern, as current blockchain networks struggle to handle increasing transaction volumes efficiently. Solutions such as layer 2 scaling techniques, sharding, and the development of alternative blockchains are essential to overcoming these limitations and ensuring the network can support widespread adoption.

User experience is another significant hurdle. DeFi platforms need to become more intuitive and accessible to attract a broader user base. Simplifying interfaces, offering comprehensive educational resources, and integrating DeFi services with familiar platforms can help bridge the gap between technical complexity and mainstream usability.

Regulatory compliance is a complex but crucial aspect of DeFi’s evolution. Engaging with regulators to establish clear guidelines and incorporating compliance measures into DeFi protocols will help mitigate legal risks and foster a safer, more reliable ecosystem.

Security concerns, including vulnerabilities in smart contracts and platform protocols, must be addressed through rigorous security audits, formal verification methods, and robust security protocols. Ensuring the safety of user funds and maintaining trust in the system are paramount for the continued growth of DeFi.

Finally, liquidity is vital for the stability and reliability of DeFi markets. Incentivizing liquidity provision through mechanisms like yield farming and liquidity mining, along with integrating cross-chain liquidity solutions, will enhance market depth and reduce volatility.

In summary, while DeFi holds the promise of transforming the global financial system into a more inclusive, efficient, and transparent ecosystem, its success hinges on addressing these critical challenges. As the DeFi space continues to innovate and mature, the potential for a decentralized financial future becomes increasingly attainable, paving the way for a more equitable and resilient global economy.

Contact us to learn more about how decentralized finance can enhance your financial operations.