What is Tokenization: Everything You’ve Ever Wanted to Know

Tokenization is reshaping the landscape of asset management and investment, swiftly evolving into the mainstream. A prime example of its transformative power is seen in Elevated Returns, a New York-based firm that revolutionized real estate investment through tokenization, achieving an impressive $18 million deal. Similarly, TheArtToken has creatively applied tokenization to the art world, offering fractional ownership of Contemporary and Post War Art, securely stored in Switzerland.

Even more. Such big players in the world of global finance often characterized by obsoleteness and conservativeness move toward tokenization processes. A couple of years ago JP Morgan launched the Onyx platform for the development of blockchain-based digital assets, as well as the JPM Coin digital token for instant fund transfers. Goldman Sachs launched its GS DAP digital asset platform earlier this year.

These groundbreaking applications highlight the vast potential of tokenization. By solving inefficiencies inherent in traditional markets, particularly through blockchain technology, tokenization democratizes asset ownership. It’s especially notable in sectors like real estate, where it’s making investment accessible to a broader audience, not just the privileged few. Furthermore, the trend of fractionalization, gaining traction in early 2023, has introduced innovative use cases, enabling investment in previously inaccessible assets.

In this guide, we will explore the ins and outs of tokenization and fractionalization, its benefits, diverse asset applications, real-world implementations, and its promising future.

Definition and Basics of Tokenization

At its core, tokenization involves converting assets into digital tokens. This process, integral to blockchain tokenization, offers a practical solution to real-world challenges. Fractionalization, a key aspect of tokenization, breaks down large assets into smaller, more manageable parts.

In the art world, tokenization allows multiple people to own fractions of a single artwork, solving the problem of high-value asset inaccessibility. Similarly, NFT fractionalization opens up new investment avenues in digital and creative assets, allowing broader participation.

Tokenization safeguards sensitive data by replacing it with non-sensitive tokens. These tokens act as stand-ins, preserving essential elements for business operations while the original data is securely stored elsewhere. Unlike encryption, tokenization is irreversible: tokens have no mathematical link to the original data, rendering them useless to attackers. Even a breached system won’t expose sensitive information.

Tokenization and fractionalization offer tangible solutions to traditional market limitations by democratizing asset ownership and enhancing liquidity. Through these mechanisms, assets previously out of reach for average investors become accessible, embodying the practical application and benefits of blockchain tokenization.

Imagine a library: instead of handling fragile, irreplaceable historical documents directly, researchers use numbered tickets. These tickets grant access to the same information but hold no intrinsic value if stolen. The real manuscripts are safely locked away, accessible only with the corresponding ticket.

Similarly, tokenization replaces sensitive data with these “library tickets.” Businesses can process, analyze, and utilize the information represented by the token without ever touching the original data, much like researchers analyze document summaries instead of the delicate originals.

This “ticket” system ensures security: even if attackers breach the library (database), they only steal worthless tokens, not invaluable historical records (sensitive data). This separation safeguards the true treasure while enabling research (business operations) to continue uninterrupted.

So, just as library tickets represent knowledge without exposing the original treasure, tokens unlock data utilization without compromising the actual sensitive information. It’s a win-win for security and business efficiency.

History and Evolution of Tokenized Assets

While the concept of asset tokenization can be traced back to the early days of Bitcoin, its practical implementation evolved alongside advancements in blockchain technology. This section delves into the fascinating journey of tokenized assets, illuminating its genesis, key milestones, and diversification into multifaceted applications.

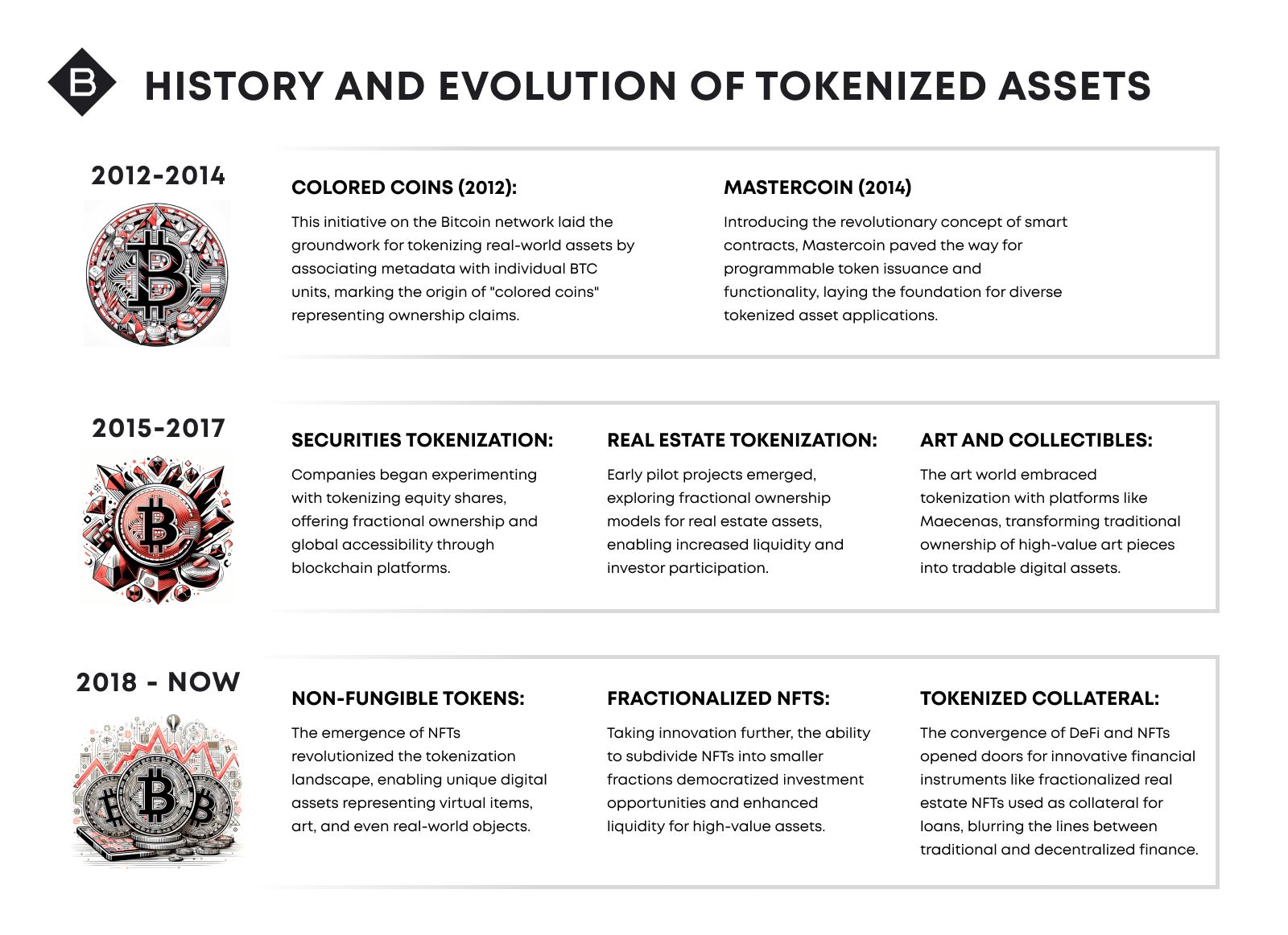

1. 2012-2014

- Colored Coins (2012): This initiative on the Bitcoin network laid the groundwork for tokenizing real-world assets by associating metadata with individual BTC units, marking the origin of “colored coins” representing ownership claims.

- Mastercoin (2014): Introducing the revolutionary concept of smart contracts, Mastercoin paved the way for programmable token issuance and functionality, laying the foundation for diverse tokenized asset applications.

2. 2015-2017

- Securities Tokenization: Companies began experimenting with tokenizing equity shares, offering fractional ownership and global accessibility through blockchain platforms.

- Real Estate Tokenization: Early pilot projects emerged, exploring fractional ownership models for real estate assets, enabling increased liquidity and investor participation.

- Art and Collectibles: The art world embraced tokenization with platforms like Maecenas, transforming traditional ownership of high-value art pieces into tradable digital assets.

3. 2018 – Now

- Non-Fungible Tokens: The emergence of NFTs revolutionized the tokenization landscape, enabling unique digital assets representing virtual items, art, and even real-world objects.

- Fractionalized NFTs: Taking innovation further, the ability to subdivide NFTs into smaller fractions democratized investment opportunities and enhanced liquidity for high-value assets.

- Tokenized Collateral: The convergence of DeFi and NFTs opened doors for innovative financial instruments like fractionalized real estate NFTs used as collateral for loans, blurring the lines between traditional and decentralized finance.

As the ecosystem matures, experts anticipate increased regulatory clarity and legal frameworks fostering further institutional adoption, broader integration of tokenized assets with traditional financial systems, and development of novel use cases, including tokenized carbon credits, intellectual property, and data monetization.

How Tokenization Works

Tokenization involves converting assets into digital forms on blockchains. This process starts with creating digital representations of assets, which are then managed through smart contracts. These contracts facilitate the fractionization of ownership, crucial for assets like real estate or art.

Read More: Blaize has already prepared a comprehensive guide on how to tokenize real-world assets.

Let’s see how it works in detail:

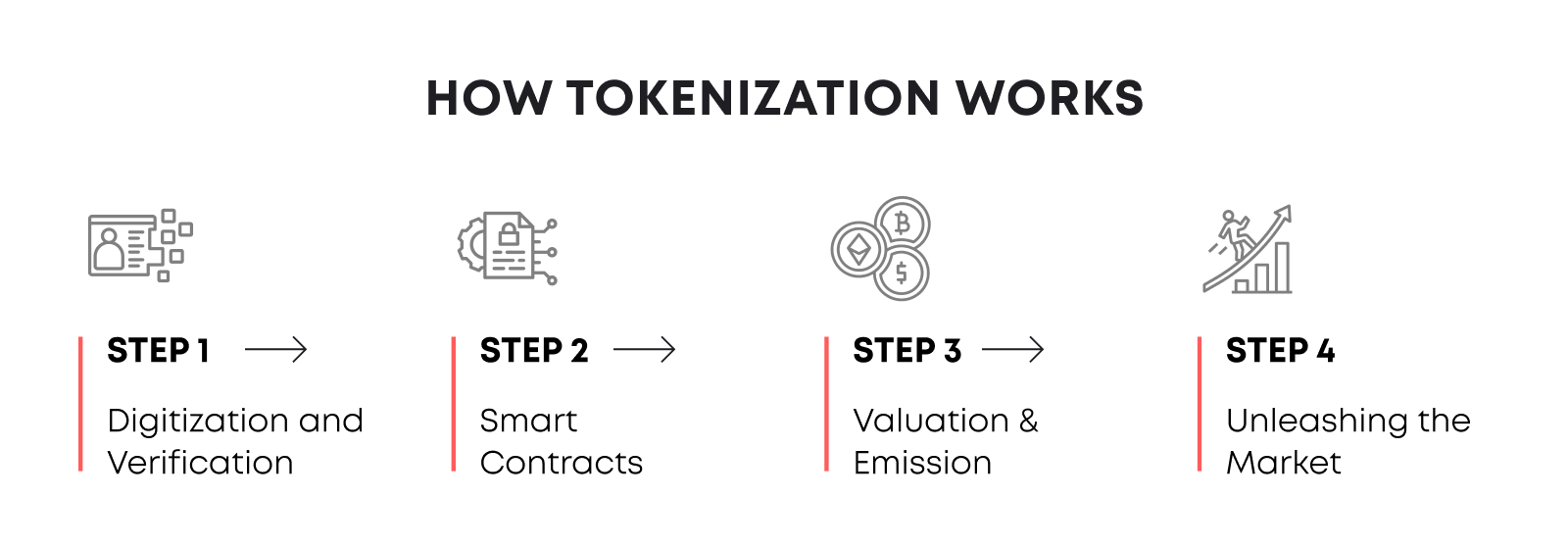

Step 1: Digitization and Verification

The initial stage of tokenization involves meticulously converting the tangible asset into a digital representation. This process entails comprehensive verification procedures to establish authenticity and determine fair market value. Similar to how a rare artifact undergoes rigorous examination, the asset is assessed by qualified professionals and assigned a unique digital identifier utilizing advanced technology. This digital counterpart serves as the foundation for subsequent fractionalization.

Step 2: Smart Contracts

Programmable smart contracts govern the fractionalization process, dictating how the asset will be divided into ownership units. These agreements, deployed on secure blockchain platforms like Ethereum (ERC-20 standard) or BNB Chain (BEP-20 standard), define the parameters of ownership distribution and transferability. Imagine them as intricate legal documents, meticulously crafted to ensure the equitable and transparent fractionalization of the asset.

Guided by the predefined fractionalization plan, the smart contract generates a finite number of digital tokens, each representing a proportional share of the underlying asset. This process mirrors the issuance of certificates of ownership, except these tokens reside on the secure and immutable blockchain, guaranteeing transparency and permanence. Envision each token meticulously assigned to a corresponding portion of the asset, granting fractional ownership rights.

Step 3: Valuation & Emission

Before fractionalization, a valuation process determines the overall value of the asset and establishes the price per token. This crucial step leverages diverse methods, depending on the asset type. The resulting valuation forms the foundation for dividing the asset into proportionally priced tokens.

With the asset digitized, fractionalized, and valued, the stage is set for emission – the creation of the tokenized fractions into the digital world. This step involves deploying the carefully crafted smart contract onto the chosen blockchain platform. Depending on the chosen protocol, specific procedures may differ, but the core purpose remains the same: to unlock the potential of fractional ownership by minting the designated number of tokenized units.

Step 4: Unleashing the Market

The newly minted tokens provide an entry point into a dynamic network of possibilities. Established blockchain tokenization platforms such as OpenSea and Rarible function as vibrant marketplaces where users can engage in the buying, selling, and trading of their tokenized fractions. Imagine a bustling virtual auction house where each tokenized brushstroke of the digital masterpiece finds its passionate owner, fostering a thriving ecosystem of fractional ownership.

Platforms like RealT are pioneering a novel approach to real estate investment. By employing tokenization, they fragment luxurious apartments and iconic skyscrapers into smaller, more manageable units, opening the door to a broader audience. This approach makes owning a piece of an iconic property like the Empire State Building a tangible possibility, transcending traditional financial limitations.

Maecenas and ArtSquare are leading a transformative movement in the art world. Through tokenization, they unlock the ownership of previously inaccessible masterpieces like Van Gogh’s Starry Night or a Banksy creation. This innovative approach liberates art from the confines of museums and galleries, democratizing access and transforming its status into a truly tradable asset.

SharesPost and tZERO are spearheading a revolution in the securities landscape. By leveraging blockchain tokenization, they enable fractional ownership of established companies like Tesla or Apple. This novel approach allows investors to diversify their portfolios by acquiring “micro-slices” of tech giants, previously out of reach for many.

Challenges & Solutions

While the allure of fractional ownership, democratized access, and frictionless liquidity beckons, the path of asset tokenization isn’t devoid of shadows. Before embarking on this transformative journey, it’s crucial to confront the potential challenges and illuminate potential solutions, ensuring a journey paved with informed navigation and mitigated risk.

1.1. Determining the fair market value of fractionalized assets can be a Sisyphean task. Traditional valuation methods may falter in this novel paradigm, with factors like liquidity, utility, and market sentiment adding layers of ambiguity. Initial offerings, secondary market trading, and algorithmic pricing models offer avenues for exploration, but the optimal approach remains an evolving enigma.

- Solution: A multi-pronged strategy holds promise. Fostering active secondary markets through partnerships with established platforms, implementing fractional trading mechanisms to enhance divisibility, and employing dynamic pricing algorithms informed by real-time market data can all contribute to a more robust and dynamic price discovery landscape.

1.2. While tokenization promises to liberate traditionally illiquid assets, the reality can be less buoyant. Niche markets or thinly traded tokens may languish in liquidity limbo, leaving investors stranded with illiquid holdings.

- Solution: Bridging the liquidity gap demands innovative solutions. Partnering with established marketplaces like OpenSea or Rarible, exploring cross-chain interoperability for broader market reach, and implementing fractional trading mechanisms to increase buy and sell orders can be instrumental in overcoming this hurdle.

1.3. The safekeeping of the underlying asset presents a unique challenge. When the physical asset remains separate from its digital twin, ensuring its security and safeguarding against potential mismanagement becomes paramount.

- Solution: Robust legal frameworks and secure custody solutions are essential to build trust and mitigate risk. Leveraging partnerships with reputable custodians, employing decentralized autonomous organizations (DAOs) for collaborative control, and developing tamper-proof digital asset management platforms can provide vital safeguards.

1.4. Should the owner decide to reclaim the original asset, the process can be a Gordian knot. Reversing the tokenization process and ensuring fair distribution among fractional owners requires careful planning and transparent communication.

- Solution: Clearly defined procedures outlined in the initial smart contract are crucial. These procedures should encompass withdrawal mechanisms, fair redemption protocols, and provisions for handling potential fractional ownership imbalances, ensuring a smooth and equitable unwinding process.

1.5. Should each fraction carry equal weight, or should a tiered system based on ownership percentage be implemented? Additionally, concerns regarding governance manipulation and ensuring proportional representation remain unresolved.

- Solution: Open dialogue and exploration of diverse models are imperative. Experimenting with tiered voting systems, implementing delegated voting mechanisms, and establishing governance councils with proportional representation can facilitate more nuanced and equitable decision-making processes.

By confronting these challenges with innovative solutions and a commitment to collaboration, we can illuminate the path toward a resilient and thriving tokenization ecosystem. As regulatory frameworks evolve and technological advancements emerge, embracing a spirit of continuous exploration and adaptation will be key to unlocking the full potential of this transformative technology.

It emphasizes the need for innovative solutions, collaborative efforts, and continuous adaptation to navigate the complexities of tokenization.

Benefits of Tokenization

Tokenization transcends mere technological novelty; it represents a paradigm shift in the very fabric of asset ownership, liquidity, and market participation. This section illuminates the core benefits that propel tokenization to the forefront of financial innovation, highlighting its potential to redefine access, enhance efficiency, and elevate transparency.

1. Fractionalized Liquidity: Democratizing Investment Opportunities

By fragmenting assets into readily tradable tokens, tokenization unlocks previously unimaginable levels of liquidity. Unlike traditional markets confined by geographical and temporal limitations, these digital fractions operate 24/7 on a global scale, attracting a diversified investor base previously excluded due to high entry barriers. This democratization fosters a vibrant environment where niche assets can attract capital from previously untapped geographical regions and demographic segments.

2. Granular Access: Revolutionizing Asset Ownership

The inherent divisibility of tokenized assets facilitates fractional ownership models, shattering the exclusivity of traditionally illiquid assets. This democratization of ownership extends to high-value items like real estate, art masterpieces, or iconic collectibles, enabling wider participation in previously inaccessible investment opportunities. Imagine co-investing in a London townhouse or a fraction of Michelangelo’s David – tokenization makes such dreams a tangible reality for both seasoned investors and aspiring participants.

3. Frictionless Efficiency: Streamlining Transactions and Reducing Costs

The integration of smart contracts into the tokenization process eliminates the need for intermediaries and cumbersome paperwork, paving the way for streamlined settlements. Transactions become instantaneous, transparent, and tamper-proof, significantly reducing administrative costs and transaction fees associated with traditional ownership frameworks. This streamlined approach fosters increased efficiency and minimizes friction throughout the entire asset lifecycle.

4. Enhanced Transparency: Building Trust through Immutable Records

Tokenization inherently elevates transparency to unprecedented levels. All transactions are immutably recorded on the blockchain, creating an auditable and verifiable trail of ownership and activity. This level of transparency fosters trust and mitigates the risk of fraud or error, providing investors with greater confidence and assurance in their holdings.

5. Beyond Ownership: Exploring the Evolving Landscape

The benefits of tokenization extend beyond mere fractional ownership and liquidity enhancement. Depending on the asset class and regulatory environment, voting rights might be attached to token ownership, enabling fractional voices to participate in governance decisions. Dynamic pricing mechanisms can be integrated into smart contracts, facilitating real-time price adjustments based on market demand and asset performance. These nascent yet promising avenues further expand the potential of this transformative technology.

By unlocking previously untapped liquidity, democratizing access to valuable assets, streamlining settlements, and elevating transparency, tokenization disrupts established paradigms and paves the way for a more inclusive and efficient financial ecosystem. As this technology matures and regulatory frameworks evolve, the boundaries of asset ownership and market participation will continue to be redefined, propelled by the transformative power of tokenization.

Types of Tokenized Assets

Tokenization is not limited to one sector; it spans real estate, funds, artwork, commodities, intellectual property, sports teams, music royalties, and more. Each category presents unique case studies and opportunities.

No longer relegated to the margins of the financial ecosystem, this transformative technology now stands poised to revolutionize the very way we own, trade, and interact with a remarkably diverse range of holdings.

From the edifices of tokenized real estate to the fragmented units of commodities, we embark on a voyage of discovery, unearthing the hidden potential locked within everything from iconic artworks to intellectual property and beyond. Each niche unveils unique opportunities that tokenization opens: democratization, liquidity, and efficiency, fundamentally reshaping the very notion of ownership and redrawing the landscape of finance as we know it.

Real Estate

Why This Niche: Traditionally illiquid and high-barrier entry, real estate is a prime candidate for democratization through fractional ownership enabled by tokenization. Investors can gain exposure to high-value properties with lower capital requirements.

How Tokenization Works: Platforms like RealT and PropTokenize fragment properties into ERC-20 tokens, allowing investors to purchase fractions that represent ownership rights. Rent income and potential property appreciation are distributed proportionally to token holders.

Top Examples:

- RealT: Fractionalized ownership of iconic properties like the Waldorf Astoria hotel.

- PropTokenize: Tokenized commercial and residential properties across the globe.

Interest and Challenges: High demand from both investors and property owners, but regulatory clarity and liquidity in niche markets remain challenges.

Financial Instruments

Why This Niche: Traditional investment funds often have high minimum investment requirements and limited accessibility for retail investors. Tokenization removes these barriers and opens up alternative investment strategies.

How Tokenization Works: Platforms like SharesPost and tZERO create tokenized representations of funds, allowing investors to purchase fractions with lower capital commitments. Performance and dividends are reflected in the value of the tokens.

Top Examples:

- SharesPost: Tokenized venture capital and private equity funds.

- tZERO: Blockchain-based trading platform for tokenized securities.

Interest and Challenges: Growing appetite for alternative investments, but regulatory compliance and investor education remain key challenges.

Read More: Shares tokenization and how it can transform your business.

Artwork

Why This Niche: High-value artwork is typically inaccessible to most investors. Tokenization unlocks fractional ownership, democratizing access to the art market and potentially increasing liquidity.

How Tokenization Works: Platforms like Maecenas and ArtSquare tokenize fractions of iconic artworks like Van Gogh’s Starry Night. Investors can purchase tokens representing ownership rights, potentially enjoying dividends from exhibition fees or future sales.

Top Examples:

- Maecenas: Fractional ownership of blue-chip artwork.

- ArtSquare: Tokenized art marketplace with curated collections.

Interest and Challenges: Growing interest from both collectors and artists, but authentication and valuation of fractions remain major challenges.

Commodities

Why This Niche: Traditional commodity markets can sometimes be complex. Tokenization can introduce greater transparency and efficiency through digital representation and trading on blockchain platforms.

How Tokenization Works: Platforms like Hyperledger Fabric and MultiChain enable the issuance of tokenized commodities like gold, oil, or agricultural products. These tokens can be traded on specialized exchanges with faster settlement and potentially lower transaction fees.

Top Examples:

- Hyperledger Fabric: Used by platforms like BNY Mellon and Mercuria for tokenized commodities trading.

- MultiChain: Provides blockchain infrastructure for various commodity tokenization projects.

Interest and Challenges: Growing interest from institutional investors and traders, but regulatory frameworks and market infrastructure for certain commodities remain underdeveloped.

Intellectual Property

Why This Niche: Intellectual property can be a valuable asset, but monetization options can be limited. Tokenization offers new avenues for commercialization and fractional ownership of intangible assets.

How Tokenization Works: Platforms like IPChain and OpenAnkura create tokenized representations of patents, trademarks, or copyrights. These tokens can be traded or used to raise capital for further development or commercialization of the IP.

Top Examples:

- IPChain: Tracks and manages intellectual property on a blockchain platform.

- OpenAnkura: Facilitates tokenized ownership and trading of IP assets.

Interest and Challenges: Growing interest from IP owners and investors, but legal and regulatory frameworks for tokenized IP are still evolving.

Sports

Why This Niche: Traditionally closed ownership structures of sports teams limit fan engagement and potential investment opportunities. Tokenization offers new ways for fans to participate and potentially share in team success.

How Tokenization Works: Platforms like Socios and Sportsology introduce fan tokens representing fractional ownership or voting rights in sports teams. These tokens can offer exclusive benefits like VIP access or merchandise discounts.

Top Examples:

- Socios: Fan tokens for teams like Barcelona and Juventus.

- Sportsology: Tokenized ownership platform for various sports franchises.

Interest and Challenges: Enthusiasm from both fans and teams is soaring, driven by the potential for deeper engagement and revenue streams. However, regulatory frameworks and ensuring fan understanding of the risks and rewards remain key challenges.

Music Royalties

Why This Niche: For musicians, royalties can be a complex and opaque system, often leaving creators with a fraction of their deserved earnings. Tokenization offers a path towards greater transparency and artist empowerment.

How Tokenization Works: Platforms like Mediachain and Musiconomi allow musicians to tokenize their royalty streams, selling fractions to fans and investors as a new revenue source. This democratizes access to music investments and provides artists with direct funding opportunities, bypassing traditional intermediaries. Imagine owning a piece of your favorite artist’s future royalties, sharing in their success and supporting their creative journey. Tokenization fosters a closer connection between artists and fans, building a more sustainable ecosystem for music creation.

Top Examples:

- Mediachain: Used by artists like John Legend and Pitbull to tokenize their music catalogs.

- Musiconomi: Provides a platform for musicians to directly connect with investors through tokenized royalties.

Interest and Challenges: The music industry is buzzing with anticipation about the potential of tokenized royalties. However, legal frameworks and ensuring fair valuation of music assets remain important hurdles to address.

Building Blocks of Tokenization

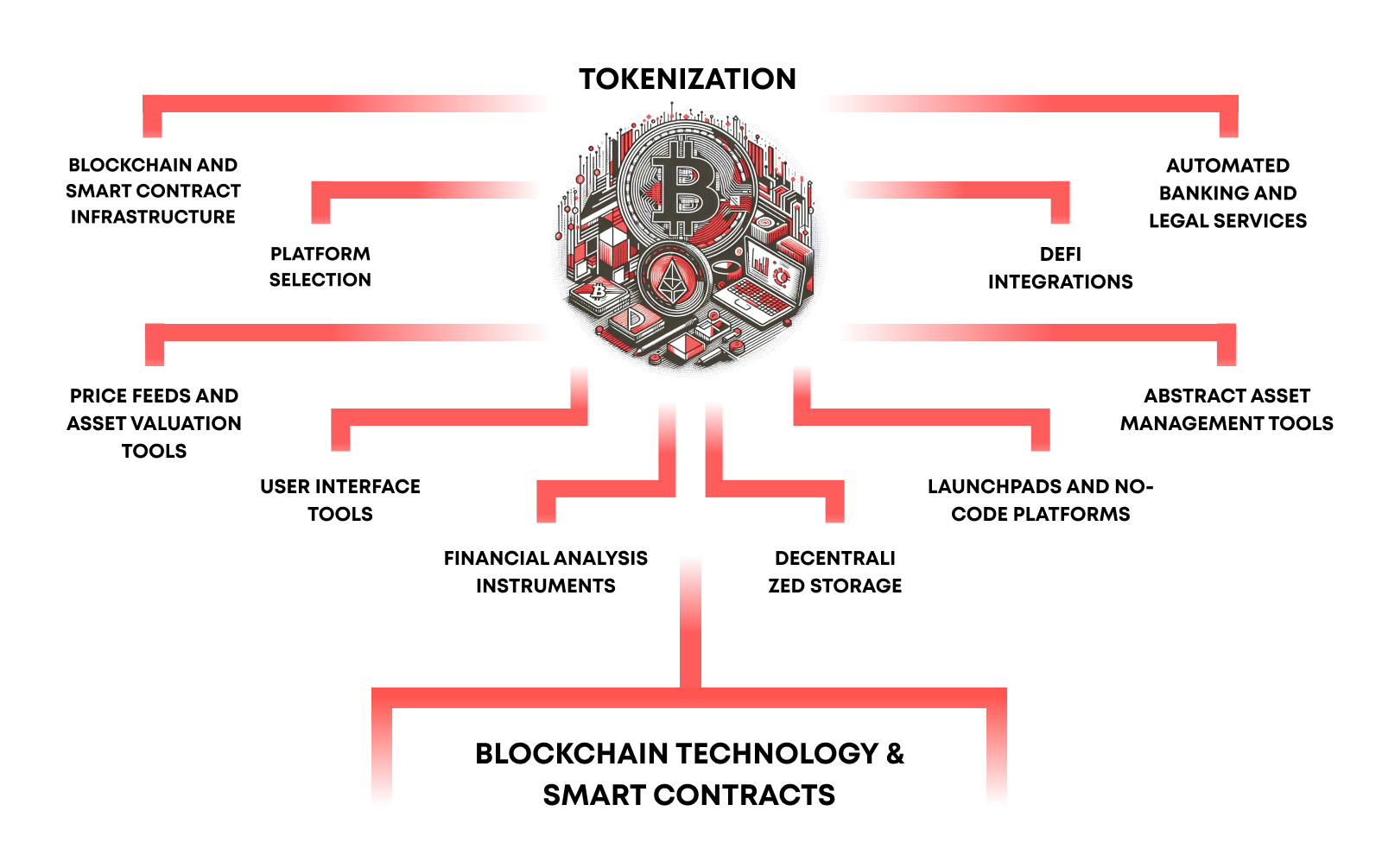

The revolutionary potential of asset tokenization is not merely a conceptual flourish. This section delves deep into the engine room of this transformative movement, dissecting the individual instruments and their harmonious interplay in bringing forth a paradigm shift in asset ownership and value exchange.

While a robust blockchain with smart contract functionality forms the fundamental layer of tokenization, the true potential unfolds through a rich ecosystem of supporting services. Choosing the right platform hinges not just on technical specifications, but on the availability of crucial tools that elevate the user experience and unlock diverse use cases. Here are some key elements to consider:

1. Blockchain and Smart Contract Infrastructure

Tokenization is fundamentally anchored in blockchain technology, particularly platforms supporting smart contracts or their chaincode analogues. This infrastructure is not just foundational; it’s a confluence of inseparability and innovation, providing the bedrock for all tokenization endeavors. Here, the blockchain acts as an immutable ledger, while smart contracts automate and enforce the rules of tokenization, ensuring security, transparency, and efficiency.

2. Platform Selection

The choice of a blockchain platform for tokenization hinges primarily on the availability and quality of services for managing tokenized assets. This involves evaluating platforms based on their ecosystem, support for various token standards, and the maturity of their development tools and community.

3. Price Feeds and Asset Valuation Tools

Accurate valuation is crucial in the tokenization landscape. Services like Chainlink, Supra Oracles, and Pyth Network provide essential tools for obtaining real-time prices and valuation of assets. Chainlink’s NFT floor price feed and Pyth’s similar offerings are exemplary in this domain, enabling precise and current asset valuation.

4. User Interface Tools

Effective management of tokenized assets requires intuitive and comprehensive UI tools. This includes portfolio managers, wallets, and dashboards that enable users to easily view and manage their portfolio of tokenized assets. The focus here is on user experience and the seamless interaction with digital assets.

5. Financial Analysis Instruments

For astute management and decision-making, tokenization platforms must offer advanced financial analysis tools. This includes P&L dashboards, candle charts, and technical analysis charts, providing users with deep insights into the value and performance of their assets.

6. DeFi Integrations

Integration with decentralized finance platforms enhances the liquidity and utility of tokenized assets. This involves the ability to use these assets as collateral, list them on exchanges, and leverage them in various DeFi protocols. For instance, tokenizing a luxury asset like a Rolls Royce could allow it to be used as collateral in a DeFi lending platform.

7. Automated Banking and Legal Services

Automation in banking and legal services is essential for the efficient issuance and management of tokenized assets. This involves streamlining processes for compliance, KYC/AML, and seamless interaction with traditional financial and legal systems.

8. Decentralized Storage

Tokenization necessitates secure and decentralized storage solutions for associated data, such as ownership documents, metadata, and digital representations (like 3D scans of artworks). This ensures permanence, security, and accessibility of crucial information.

9. Launchpads and No-Code Platforms

The emergence of launchpads and no-code platforms for tokenization democratizes access, allowing businesses and individuals to tokenize assets without extensive technical expertise. These platforms simplify the process, making it more accessible and efficient.

10. Abstract Asset Management Tools

Innovations in asset management tools allow for interaction with tokenized assets through more user-friendly interfaces, such as emails, messengers, and enhanced UIs. This includes the concept of account abstraction, where services provide a more integrated and seamless asset management experience.

As blockchain technology matures and permeates diverse industries, the competition is no longer about the underlying infrastructure itself, but about the quality and accessibility of the services built upon it. Choosing the right platform for tokenization goes beyond technical specifications; it’s about finding the ecosystem that provides the most comprehensive suite of tools to manage, analyze, and leverage your tokenized assets effectively.

By focusing on user experience, frictionless workflows, and seamless integration with DeFi applications, the future of tokenization lies not just in the blockchain, but in the vibrant ecosystem of services that empower individuals and businesses to unlock the full potential of this transformative technology.

The ubiquity of blockchain technology sets the stage for intense competition within the realm of service offerings. The focus now shifts to platforms that provide the best, most rapid integration solutions for specific business cases, emphasizing a seamless blend of technological innovation and practical utility.

In this dynamic environment, the building blocks of tokenization are not just technological components; they represent a holistic ecosystem designed to support and enhance the value and utility of digital assets in a rapidly evolving digital economy.

The Future of Tokenization

As the foundational architecture and regulatory frameworks surrounding tokenization solidify, a compelling picture of its seismic potential emerges. Beyond niche applications, experts envision a future where tokenization unlocks trillions of dollars currently trapped in illiquid assets, fundamentally reshaping ownership, democratizing financial access, and fueling unprecedented economic dynamism. However, navigating open challenges and driving key innovations remain crucial to fully realize this transformative vision.

Tokenization fragments valuable assets like real estate and artwork into granular fractions, creating globally accessible liquidity pools and democratizing investment opportunities. Imagine tokenized shares of iconic landmarks or fractional ownership of priceless paintings, fostering wealth creation and broader societal participation in the financial system.

Tokenization disrupts rigid ownership structures, enabling dynamic models through fractional ownership and empowering individuals to invest in previously unattainable assets. DAOs further democratize control by allowing collective ownership and management of valuable assets like art collections or intellectual property.

Challenges like regulatory uncertainty, technological limitations, and user-friendliness need to be addressed. However, a wave of innovation is already tackling these hurdles. Evolving regulatory frameworks, blockchain scalability solutions, and user-centric platforms are paving the way for wider adoption.

Integration with DeFi protocols unlocks novel use cases like fractionalized asset-backed loans and yield generation. Emerging technologies like NFTs further broaden the scope, empowering creators to monetize digital assets and enabling tokenized collectibles and experiences.

By recognizing the disruptive potential of tokenization, embracing innovation, and addressing open challenges, we can collectively usher in a future where asset ownership is democratized, financial access is broadened, and economic dynamism reaches unprecedented heights. This transformative revolution stands poised to redefine the very fabric of financial markets and economic systems.

Reach out Blaize to discover the immense opportunities for your business with tokenization.