How to Tokenize Real-World Assets?

In the sphere of financial innovation, the tokenization of real-world assets (RWAs) stands out as a transformative force, redefining the paradigms of asset management and investment.

As predictions place the market for tokenized assets at an astounding $16 trillion by 2030, comprehending this avant-garde technology is not just beneficial – it’s imperative. This comprehensive guide demystifies the concept, unveils the multitude of benefits, and provides a meticulous walkthrough of the tokenization process.

Read also: How Blaize dived into the intricacies of shares tokenization and its benefits for your business.

What is Asset Tokenization?

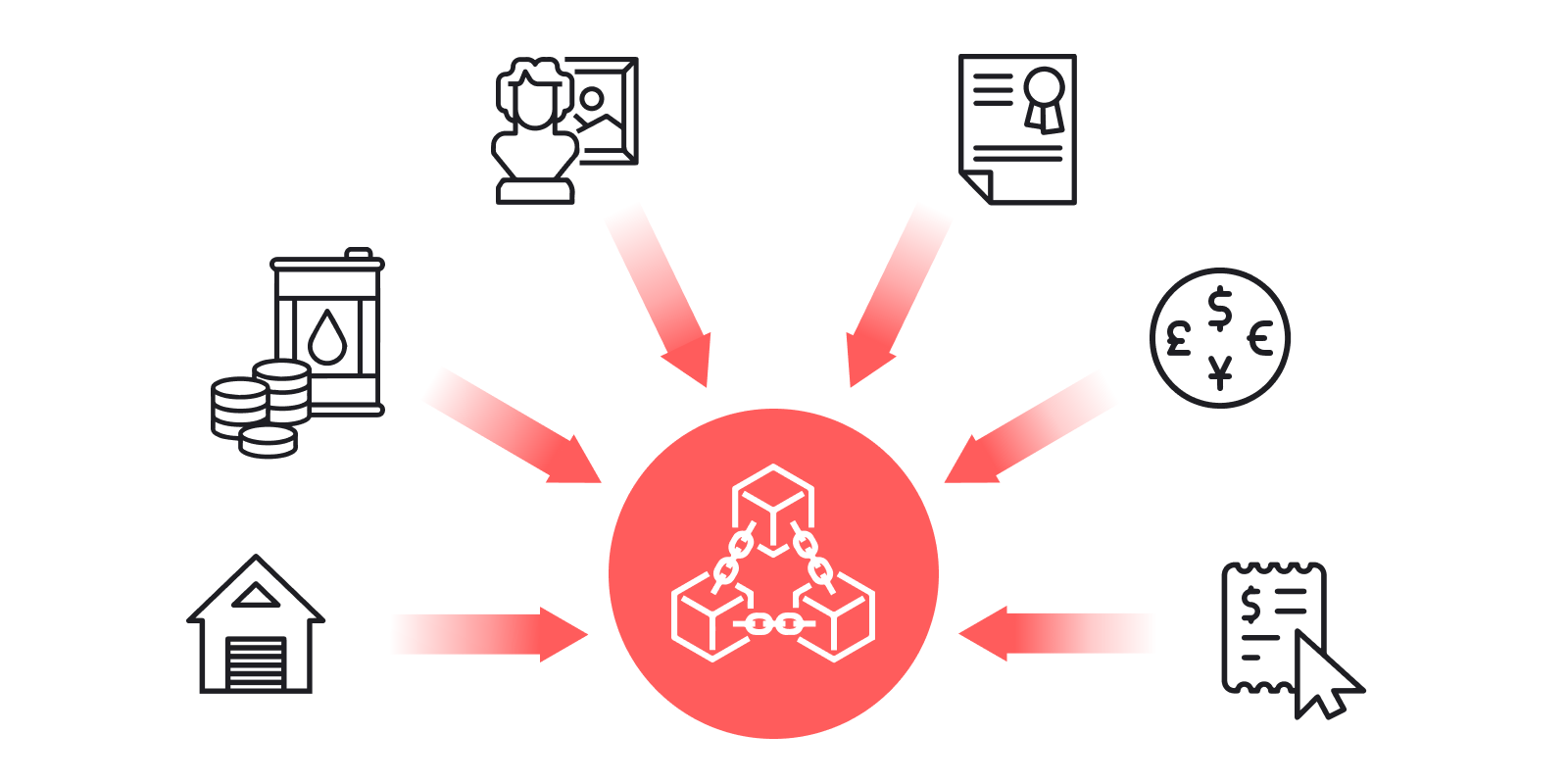

Real-World Asset (RWA) Tokenization refers to the process of converting the ownership rights of tangible or intangible assets into digital tokens on a blockchain platform. This innovative approach allows for the representation of a wide array of assets – such as real estate, artwork, commodities, and financial instruments – in a digital form that can be traded and owned fractionally.

At its core, RWA tokenization involves the creation of digital tokens that reflect a stake, share, or ownership in a real world asset. These tokens are typically issued on a blockchain, which provides a secure and transparent ledger for recording the ownership and transfer of tokens. Blockchain technology not only facilitates the proof of ownership but also ensures the immutability of transaction records, enhancing trust among participants.

By tokenizing assets, issuers can offer a divisible, and often more accessible, form of ownership. This can lower the barrier to entry for investors, allowing for increased liquidity and broader distribution of asset ownership. Furthermore, the process promises greater efficiency in asset management and transfers, reduced costs, and enhanced market resilience through distributed ledger technology.

Discover Blaize’e expertise in developing web3-based solutions for enterprises here.

How Does Asset Tokenization Work?

Asset tokenization is a structured process that transforms the rights to a real world asset into a digital token on a blockchain. Here’s a step-by-step breakdown of how it works:

1. Asset Selection and Legal Structuring:

The process begins with selecting a suitable asset for tokenization. This can be any tangible or intangible asset with value, such as real estate, art, or financial instruments. Legal experts must then structure the asset into a token-friendly format, ensuring compliance with relevant regulations and establishing the legal framework that dictates the rights and responsibilities of token holders.

2. Due Diligence and Valuation:

Prior to tokenization, the asset undergoes thorough due diligence to confirm its legitimacy, value, and title. A valuation is conducted by certified professionals to ascertain the asset’s current market value, which will underpin the pricing of the tokens.

3. Token Creation and Issuance:

Once the legal groundwork is laid, tokens representing shares in the asset are created on a blockchain platform. These tokens are designed to be compliant with existing standards such as ERC-20 or ERC-721 on the Ethereum blockchain, ensuring compatibility with a wide range of wallets and exchanges. The technical aspect includes smart contract creation, which will govern the tokens’ behaviors and rights, such as transfers, dividends, or voting rights.

4. Distribution and Trading:

Tokens are then distributed to investors through private sales, auctions, or public offerings, depending on the regulatory framework. Post-distribution, these tokens can be listed on secondary markets – specifically those that handle security tokens – allowing for trading and providing liquidity to token holders.

5. Regulatory and Compliance Management:

Throughout the token’s lifecycle, issuers must manage ongoing regulatory and compliance requirements. This includes reporting, maintaining investor relations, and ensuring that the trading of tokens complies with the laws of the jurisdictions where they are traded.

6. Asset Management and Servicing:

The issuer also takes responsibility for the management of the underlying asset, including any necessary maintenance, rent collection if it’s a property, or authenticity verification in the case of collectibles. The performance of the asset can be tracked and reported to token holders, providing transparency and trust in the investment.

Tokenization leverages blockchain’s inherent advantages such as immutability, transparency, and security to streamline the entire lifecycle of asset management, thereby making previously illiquid assets accessible and tradable on a global scale.

Examples of Real World Assets

The scope of tokenizable assets is vast and varied. This part will probe into various assets that are ripe for tokenization, including fine art, precious stones, and equity, supplemented by case studies of pioneering real world asset tokenization projects.

| Asset Type | Description | Tokenization Example Projects |

| Real Estate | Physical property assets, both residential and commercial. | RealT: Tokenizing U.S. real estate properties. |

| Art & Collectibles | High-value artwork and collectible items. | Maecenas: Offering fractional shares in fine art. |

| Commodities | Tradable resources like gold or oil. | Paxos Gold (PAXG): Tokens backed by gold reserves. |

| Debt Instruments | Financial obligations like loans or bonds. | Figure: Blockchain-based home equity lines of credit using Provenance blockchain. |

| Equity | Ownership shares in companies or ventures. | tZERO: A platform for trading tokenized securities, including private company equity. |

| Intellectual Property | Rights to a creation such as music, patents, or software. | Myco: Intellectual property tokenization for creators and inventors. |

| Infrastructure | Public or private projects like bridges or renewable energy plants. | SolarCoin: Tokens incentivizing solar energy generation. |

These real-world examples demonstrate the active application of blockchain technology in various domains, enabling fractional ownership, increased liquidity, and democratization of access to asset classes traditionally reserved for institutional investors or high-net-worth individuals. Each project is a testament to the versatility and real-world impact of asset tokenization.

Benefits of RWA Tokenization

Asset tokenization brings a host of benefits that are set to transform the way we view and manage assets. This section highlights the key advantages, emphasizing the major changes it’s expected to bring to asset management.

Liquidity Enhancement

Definition: Liquidity refers to the ease with which an asset can be bought or sold in a market without affecting its price. Tokenization can convert traditionally illiquid assets into divisible and easily transferable tokens, facilitating a smoother and more efficient market.

Impact: This liquidity transformation can unlock value in assets by enabling partial ownership and reducing the capital requirements for investment. For instance, real estate, a typically illiquid asset, can be tokenized to allow fractional ownership and trading on secondary markets, thereby widening the investor pool.

Democratized Ownership

Definition: Democratization in this context means lowering the barriers to entry for investors, allowing more people to participate in markets that were previously inaccessible due to high minimum investments or regulatory restrictions.

Impact: By breaking down assets into smaller, more affordable tokens, RWA tokenization can broaden market access, creating a more inclusive investment landscape. This has the potential to balance wealth distribution and stimulate economic growth by mobilizing capital from a larger investor base

Efficient Asset Management

Definition: Asset management involves maintaining and monitoring assets to ensure their value is preserved or enhanced. Tokenization can automate several aspects of this process through smart contracts and blockchain technology.

Impact: The utilization of blockchain in asset management introduces efficiencies by reducing the need for intermediaries, simplifying the transaction processes, and enhancing the accuracy of record-keeping. This could lead to significant cost savings and increased asset performance transparency.

Transparent Transactions

Definition: Transaction transparency implies that all parties have access to the same information and can verify the authenticity of transactions. Blockchain’s immutable ledger ensures that once a transaction is recorded, it cannot be altered without consensus from the network.

Impact: This level of transparency builds trust among participants and can significantly mitigate fraud. It also simplifies compliance with regulatory standards and audit requirements, contributing to a more secure and reliable financial ecosystem.

By addressing these aspects with specificity and clarity, the benefits of RWA tokenization are articulated in a manner that is both accessible to those new to the concept and informative to seasoned industry professionals.

Challenges of Real-World Asset Tokenization

Regulatory Compliance and Legal Framework

Tokenizing real-world assets involves navigating complex and often unclear legal landscapes. Different jurisdictions may have varying regulations concerning digital assets, securities, and taxation that can impact the tokenization process.

For instance, determining the classification of tokenized assets (whether they are securities, commodities, or a new category) can affect compliance requirements. Legal challenges also include ensuring the enforceability of tokenized asset ownership and transfer in courts, considering traditional legal systems are not always equipped to handle blockchain transactions.

Proof of Ownership

The main problem with tokenization is that anyone can create and issue tokens. However, a tokenized asset has its legal value only if it is issued by a legal entity – or an entity that legally can confirm the proof of ownership. That is why RWAs are always closely connected with the issuance of proofs together with the asset – e.g. issuance of the on-chain certificate which confirms the asset origin and right to issue its tokenized version. It creates an additional task for blockchain engineers and legal representatives to create an acceptable form of the on-chain representation of the origin of ownership.

Technical Standardization and Integration

A lack of standardization across blockchain platforms can lead to interoperability issues, making it difficult for tokenized assets to be traded or managed across different systems.

Ensuring the technical robustness to support the tokenization of various asset classes requires developing standardized protocols and APIs that facilitate the seamless exchange and management of tokens on different blockchains.

Additionally, integrating tokenization into existing financial infrastructures without disrupting operations poses a technical hurdle.

Price Feeds

One of the biggest technical tasks for RWAs is the integration of up-to-date and verifiable prices for the original asset. It is the same type of problem stablecoins and other pegged assets face: how to bind the issued tokenized RWA to the price obtained from its evaluation? Stablecoins may go with Proof-of-reserve – services that confirm the supply of fiat or cryptocurrencies that back the stablecoin. Pegged assets usually have complex on-chain mechanisms based on supply/demand principles. But it becomes more complicated for the RWAs, as they are subjects of re-evaluations, auctions, share re-issuance, inflation, and other factors (especially for art or real estate). Therefore, the launch of reliable price feeds is crucial for the evaluation of each token that represents the tokenized RWA.

Liquidity Concerns

While tokenization is praised for enhancing liquidity, the nascent state of markets for tokenized assets can sometimes result in lower liquidity than anticipated, especially in the short term.

Liquidity is highly dependent on market depth and the presence of a broad investor base. Developing this market infrastructure is crucial to ensuring that tokenized assets can indeed be traded efficiently and without significant price impact.

Data Privacy and Security

Ensuring the privacy and security of tokenized assets is imperative, given the sensitivity of the data bound to the RWA. For example, most private collectors and art owners who decide to work with tokenization mechanisms, will not be glad to uncover themselves publicly. Thus the tokenization platform should implement a high standard of data privacy. Or, as another example, the real estate market is sensitive to internal information disclosure and has already faced a lot of fraud and “data haunting threats”. Therefore the platform for real estate tokenization should have a cybersecurity team ready to handle any data breaches and security incidents..

So, tokenization platforms must uphold cybersecurity standards to protect against hacking, unauthorized access, and fraud. Additionally, balancing transparency with privacy, especially in compliance with regulations like GDPR, is a challenge that requires sophisticated data management solutions.

How to Tokenize Real-World Assets

The tokenization of real-world assets transforms physical and non-physical assets into digital tokens on a blockchain, enabling ownership to be divided, verified, and traded. Here’s a structured approach to the tokenization process:

1. Asset Evaluation

Initial Steps: This involves a comprehensive assessment of the market value of an asset, that has tangible value and is eligible for tokenization market value, its ownership rights, and potential to offer returns on investment.

2. Legal Structuring and Compliance

Regulatory Compliance: Establish a legal framework following relevant securities laws and regulations. This involves consulting legal experts to structure the offering, be it a utility token or a security token, and ensuring compliance with KYC and AML requirements.

3. Choosing the Blockchain Platform

Selection Criteria: Select a blockchain platform that aligns with the asset’s requirements in terms of security, scalability, and regulatory compliance. Consider factors such as transaction costs, community support, and availability of infrastructure/protocols that will accept tokens as liquidity or will give trading opportunities.

Platform Examples: Public Platforms like Ethereum itself, for its extensive smart contract capabilities, or specialized platforms like Securitize or Polymath, which are tailored for securities tokenization, are commonly chosen.

4. Launch Preparation

This phase includes developing real-time price feed services, creating digital proof of ownership certificates, and deploying smart contracts for token management.

5. Token Creation and Issuance

Token Design: Define the characteristics of the token: total supply, and divisibility (as a limit of fractionalization), connection with ownership certificate, minting rules, and rules for redeeming RWA or its value. Decide on the rights and benefits that token holders will receive.

Minting Tokens: This process creates a specified number of tokens, which represent shares in the asset’s value. This is a crucial point, as minting follows rules for the initial supply and initial offering, defines the responsible roles or mechanisms for future minting stages, etc.

6. Distribution and Trading

Launch: Distribute tokens to investors through a public offering, private placement, or other distribution methods. Utilize cryptocurrency exchanges or specialized trading platforms for secondary trading.

Secondary Market: Establish a presence on secondary markets to enhance liquidity and provide investors with a platform to buy and sell tokens.

7. Ongoing Asset Management and Reporting

Asset Servicing: Implement a robust asset management system to handle investor relations, reporting, and compliance monitoring post-tokenization.

Transparency: Regularly provide token holders with transparent reporting on asset performance, management decisions, and financial results.

8. Exit Strategy

Strategic Planning: Develop an exit strategy for investors, which may include buy-back options, token burn mechanisms, arranging for a third-party acquisition, or even full redemption of the original RWA to the new owner.

This structured approach to tokenization ensures that each phase is executed with diligence, from asset selection through to the management and potential exit strategies. It is essential to engage with legal advisors, blockchain experts, and financial consultants throughout this process to ensure the tokenization of real-world assets is performed with professional rigor and strategic planning.

Blaize Expertise

Blaize provides bespoke tokenization services, with a focus on security and regulatory adherence, bridging the gap between traditional finance and blockchain innovation. Our adept team navigates complex tokenization processes, offering end-to-end solutions that are both scalable and secure. Post-deployment, we deliver ongoing support to respond to evolving market demands.

Explore our detailed case studies for a deeper understanding of our methodical approach and successful implementations of RWA tokenization principles.

As the most vivid example of our work with RWA tokenization, let’s mention the project on tokenizing luxury goods, with premium watches as the first phase assets. Unfortunately, the case is under NDA, but we can disclose the main challenges we faced.

The first problem was confirming ownership. How do we ensure the confirmation of ownership of an expensive watch? In our case, the client had an arrangement with a bank: the client acts as a platform for issuance, and the bank acts as a legal mediator to confirm ownership. A platform user who wants to tokenize his luxury goods contacts the platform, the platform transfers those goods into the bank’s depositary cell, and the bank issues a digital confirmation of the goods being stored with a connection to the owner. Our team’s first task was the creation of the on-chain representation of this certificate as proof of ownership.

The second problem was the price. However, this problem was resolved quite easily, as the bank, along with confirming ownership, also conducted a preliminary valuation of the goods and noted it in the certificate. Therefore, our team already had a starting price. This is the initial price that our team put into the smart contract responsible for the issuance of tokens for the luxury goods. Further price feed was based purely on on-chain info and auction mechanisms implemented in smart contracts. Thus, in this case, the initial price provided by the legal evaluation entity was enough to launch the automated evaluation mechanism.

Next, the process was quite standard – the number of tokens (which made sense as shares of ownership) was determined by the asset owner. Having the price, the number of tokens, and proof of ownership, the subsequent mechanism of public offering was a piece of cake for our smart contract engineering team.

Platform rules were simple:

- auction mechanics for asset price reevaluation;

- ERC20 tokens issued for the RWA and distributed via the public offering based on the initial price;

- the owner of the majority of tokens may initiate the process of the redemption of the RWA based on the price agreed among all token holders.

However, such simple rules were possible after the careful platform design process and solving the initial problems from the legal side.

Future Trajectories

The trajectory of asset tokenization is poised to reshape the landscape of investment and asset management.

Advancements in Regulatory Frameworks

As tokenization permeates the global market, we can expect more refined regulatory guidelines to emerge. These frameworks will likely address current ambiguities and create standardized practices, fostering a secure environment for both issuers and investors. Regulatory advancements are crucial for the widespread adoption and acceptance of tokenized assets.

Integration with Traditional Financial Systems

Tokenization will increasingly integrate with conventional financial systems, enabling a seamless transition between digital and fiat currencies. This will facilitate easier exchange and liquidity, creating a hybrid financial ecosystem where traditional and digital asset transactions are indistinguishable in practice.

Technological Innovation

Blockchain technology, the bedrock of asset tokenization, is advancing rapidly. We foresee the advent of new platforms that offer enhanced scalability, reduced transaction costs, and increased transaction speeds. Innovations such as Layer 2 solutions and cross-chain interoperability will further expand the potential of tokenized assets.

Expansion of Asset Classes

While real estate, art, and commodities are commonly tokenized today, the future will likely see a diversification of asset classes. This could include intellectual property rights, personal data, and even unconventional assets like carbon credits and natural resources.

Tokenization as a Service (TaaS)

Service platforms dedicated to simplifying the tokenization process for various assets are set to become more prevalent. These platforms will offer end-to-end solutions, from legal compliance and token creation to distribution and liquidity management.

Enhanced Market Efficiency

Tokenization stands to enhance market efficiency significantly. The fractionalization of assets and the subsequent democratization of investment opportunities will create a more inclusive market. This will allow for better price discovery and reduced spreads due to increased market participation.

Broader Geographic Reach

Tokenization eliminates many geographical barriers, granting access to international investment opportunities. This global reach will enable the flow of capital across borders with ease, promoting economic growth and diversity in investment portfolios.

Advanced Asset Management Tools

The maturation of tokenization will lead to the development of sophisticated asset management tools that utilize AI and machine learning. These tools will provide predictive analytics, risk assessment, and automated management strategies for tokenized assets.

In conclusion, the potential trajectory for the tokenization of real-world assets is vast and multi-faceted. As the technology matures, and as legal and operational infrastructures evolve, tokenization is set to become a pivotal element in the future financial and investment landscapes. For industry participants and observers alike, these advancements herald a transformative era in asset management and investment accessibility.

Closing Remarks

We conclude by reflecting on the significance of real-world asset tokenization and its capacity to revolutionize financial landscapes. Emphasizing the pivotal role of expert partners like Blaize, we underscore the transformative potential of this technology and the bright future it portends for those who embark on the tokenization journey.