Blockchain Bridges: A Deep Dive into Cross-Chain Interoperability

In the ever-evolving world of blockchain technology, the concept of blockchain bridges has emerged as a critical solution for creating and enhancing cross-chain interoperability across diverse networks. Blockchain bridges emerge as a perfect solution to the fragmentation dilemma. These protocols operate as secure, trust-minimized conduits, traversing the chasms between isolated networks and enabling the frictionless exchange of assets.

To better understand the essence of blockchain bridges, imagine:

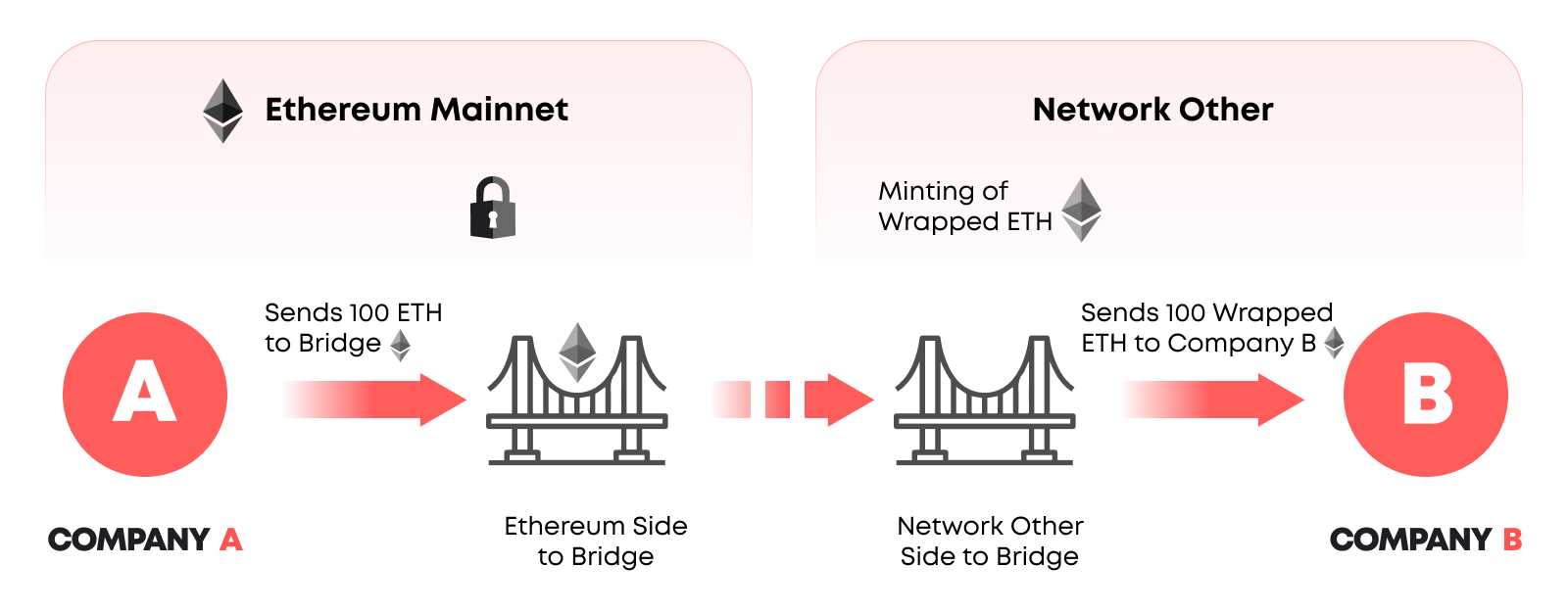

Problem: A gaming company A on the Ethereum network, and company B, operating on BNB Chain, have users who want to trade digital assets between these two distinct blockchains. However, direct asset exchange is only possible due to compatible protocols.

Solution: A blockchain bridge is introduced, connecting Ethereum and BNB Chain. It allows Company A players to securely trade their Ethereum-based assets with Company B users on the BNB Chain. Assets are ‘locked’ in a smart contract on one blockchain and an equivalent asset is ‘minted’ on the other, facilitating seamless cross-chain asset trading.

In the absence of bridges, crypto assets remain tethered to their native networks, unable to participate in other ecosystems being ‘isolated’. This fragmentation stifles liquidity, impedes DeFi adoption, and ultimately limits the scope of crypto’s revolutionary potential.

With over 25 blockchains in our comprehensive expertise and countless bridge cases, we’ve accumulated real-world experience and insights. In this article, we’ll not only explain the technical intricacies of bridges but also share our practical experience in the domain. So let’s dive in!

What Are Blockchain Bridges

Blockchain bridges are protocols that facilitate the transfer of assets and data between different blockchains. They act as intermediaries, navigating the technical and security complexities of disparate networks to enable the frictionless flow of value. This cross-chain interoperability unlocks a wealth of benefits, transforming the fragmented crypto landscape into an interconnected system.

Blockchain bridges act as the architects of interoperability, seamlessly connecting previously isolated blockchain ecosystems. They enable the transfer of assets beyond simple swaps, empowering you to unlock opportunities that transcend individual networks.

Imagine holding ETH but discovering a lucrative DeFi yield farming opportunity on the Polygon network. Traditionally, you’d be forced to sell your ETH, incur conversion fees, and potentially miss out on fleeting market movements.

Bridges offer a more strategic solution. You can deposit your ETH into the bridge, which securely locks it and mints an equivalent amount of “wrapped” WETH on the Polygon network. This WETH functions identically to native ETH within the Polygon ecosystem, allowing you to participate in the desired yield farm without sacrificing your original position.

This scenario exemplifies the true power of bridges: unlocking diverse use cases beyond straightforward asset swaps. Whether you seek better DeFi rates, explore innovative dApps, or capitalize on arbitrage opportunities, bridges empower you to leverage the full potential of your assets across a multitude of chains.

Remember, while bridges offer distinct advantages, they may involve slightly higher fees compared to centralized exchanges. Additionally, their value shines brightest when seeking opportunities for the same asset across different networks. By choosing the right bridge and understanding its specific fees and functionalities, you can effectively navigate the interoperable landscape and maximize your blockchain experience.

This is just one example of the transformative power of blockchain bridges. Their impact extends far beyond individual user convenience, fostering a more efficient digital economy:

- DeFi Growth: Bridges empower users to access and optimize DeFi protocols across multiple networks, maximizing yield opportunities and diversifying risk.

- Liquidity Liberation: Trapped assets gain freedom, injecting crucial liquidity into decentralized exchanges and fostering efficient price discovery across diverse token ecosystems.

- Innovation: Unfettered asset flow fuels the development of next-generation cross-chain applications and protocols, leading to unprecedented levels of collaboration and innovation within the cryptosphere.

Blaize has prepared a comprehensive guide on cross-chain interoperability, explaining its pros and cons and considering several real-life examples. The article is already available under the link.

How Do Blockchain Bridges Work

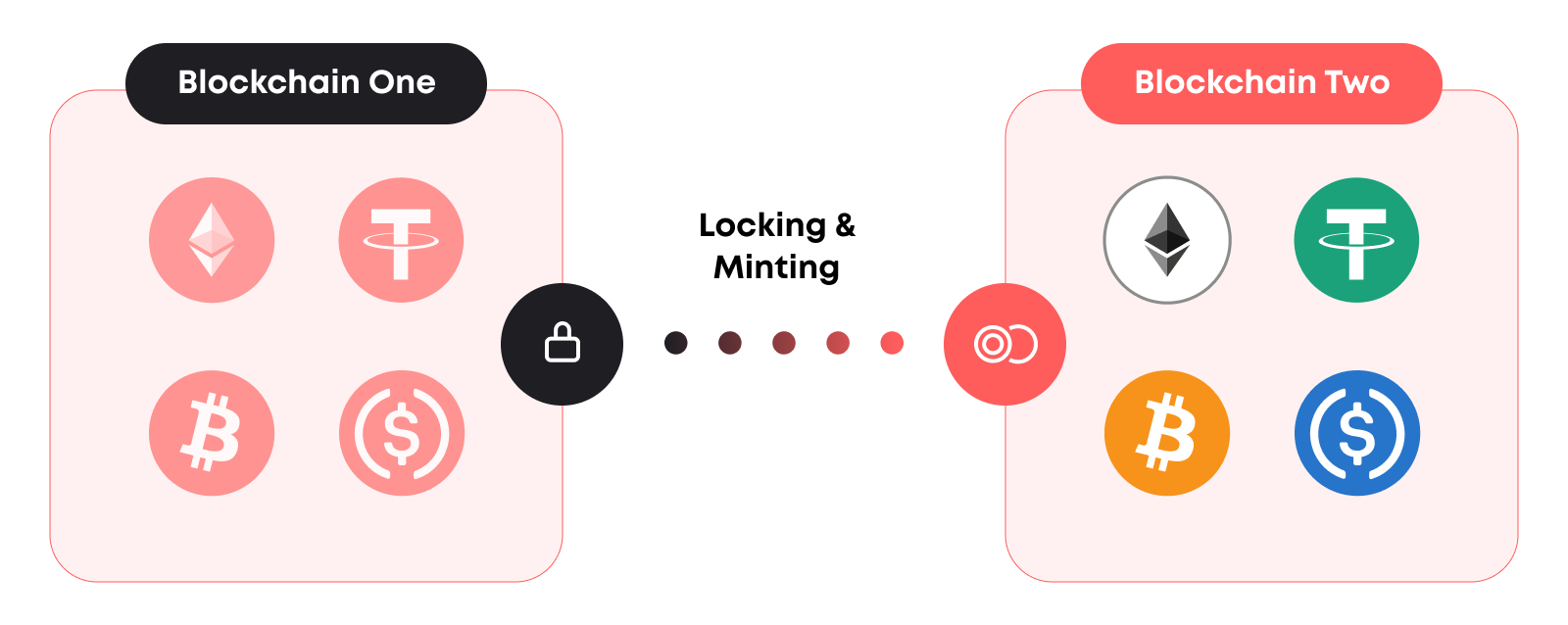

Blockchain bridges employ advanced mechanisms to ensure secure and efficient cross-chain interactions. These methods vary but primarily include the Wrapped Asset Method and the Liquidity Pool Method.

Wrapped Asset Method

This approach involves ‘wrapping’ an asset from one blockchain into a token on another blockchain. This wrapped token represents the same value and can be unwrapped back into the original asset, ensuring asset portability across blockchains.

The wrapped asset method adopts a custodian-like approach, safeguarding your original asset while facilitating its interaction on the target chain.

- Escrow of Origin: When you initiate a bridge transaction, your native asset gets deposited into a dedicated smart contract on the source chain. This smart contract acts as a secure vault, locking your asset out of circulation and guaranteeing its return upon redemption.

- Mirror Image Minting: Concurrently, on the target chain, an equivalent amount of “wrapped” tokens is minted. These tokens, pegged 1:1 to your original asset, function seamlessly within the target network, granting you access to its DeFi protocols, exchanges, and dApps.

- Unwrapping the Value: To return home, you submit a redemption request on the target chain. Upon verification, the corresponding wrapped tokens are burned, and the smart contract on the source chain releases your original asset, completing the safe passage back to its native realm.

While prioritizing security with its escrowed custodianship, this method introduces a degree of centralization. The smart contract holding your assets becomes a potential vulnerability, and its design and operational security become paramount considerations

Liquidity Pool Method

In this method, liquidity pools are used to facilitate asset transfers. Users deposit assets into a pool on one blockchain and receive an equivalent value on another blockchain. This ensures liquidity and seamless transfers across different networks. Instead of individual copies, the liquidity pool method envisions a constantly flowing river of cross-chain value.

- Contributing to the Flow: To initiate a bridge crossing, you deposit your native asset into a liquidity pool on the source chain. This pool, governed by smart contracts, dynamically manages the total value locked on both sides of the bridge, ensuring a balanced ratio of native and wrapped tokens.

- Swapping with Precision: By exchanging your tokens within the pool, you trigger the automatic minting or burning of wrapped tokens on the other side, effectively swapping your asset’s native form for its cross-chain doppelganger. Smart contracts ensure precise exchange rates and maintain sufficient liquidity in both pools.

- Maintaining Equilibrium: To guarantee the bridge’s smooth operation, advanced algorithms constantly adjust the pool sizes on both sides, balancing supply and demand. This dynamic equilibrium incentivizes user participation and rewards liquidity providers for contributing to the bridge’s functionality.

While offering a more decentralized approach, the liquidity pool method introduces considerations like potential price slippage (temporary deviations from desired exchange rates) and impermanent loss (risks faced by liquidity providers due to changing pool ratios).

By understanding these intricate mechanisms, we gain a deeper appreciation for the technological prowess of blockchain bridges.

Benefits of Blockchain Bridges

The blockchain bridges’ transformative power and plenty of opportunities for businesses lies in a multitude of benefits, each paving the way for a more efficient, inclusive, and innovative crypto ecosystem. Let’s explore some of the key advantages unlocked by these digital arteries.

Enable Cross-Chain Connectivity

Blockchain bridges play an essential role in enabling cross-chain connectivity, allowing different blockchain networks to communicate and share resources, thereby facilitating a modular and interconnected blockchain architecture.

Arbitrage Opportunities

With assets now free to roam across chains, discrepancies in prices and conditions become ripe territory for exploitation. Imagine Bob, the DeFi enthusiast. He meticulously scans liquidity pools across various chains through bridges, spotting a juicy opportunity. Ethereum yields a measly 5% on his stablecoin, while Fantom beckons with a tempting 12%. With a simple move, Bob bridges his stablecoin over, maximizes his returns, and bridges it back, pocketing the handsome interest differential. Bridges not only provide an opportunity for diverse DeFi protocols but also empower nimble players to capitalize on fleeting disparities in rates across the interoperable landscape.

Independence and Interoperability

Protocols once limited to fundraising on Ethereum, like Hyperliquid and dYdX, can now migrate development to their own chains, fostering greater autonomy and tailored functionality. Bridges seamlessly transfer liquidity between chains, allowing these protocols to integrate new blockchains and expand their user base while retaining essential liquidity pools.

Furthermore, the rise of dedicated dApp chains, like those planned by Hyperliquid and dYdX, opens up entirely new possibilities. These chains can mint NFTs directly, leveraging established bridges to attract early liquidity and users from diverse blockchain ecosystems. In essence, NFT bridges empower protocols and dApps to break free from their original chains, embrace multi-chain functionality, and chart their own independent yet interconnected futures.

Improve Scalability

Blockchain bridges play a crucial role in expanding the overall capacity of the decentralized ecosystem. Bridges operate as bypasses, efficiently distributing transaction load across multiple chains. This alleviates pressure on individual networks, boosting throughput and paving the way for broader adoption. By enabling concurrent activity across diverse chains, bridges effectively expand the bandwidth of the entire blockchain landscape, fostering a more scalable and inclusive future for decentralized technology.

These are just a few of the transformative advantages offered by blockchain bridges. In the following sections, we’ll delve deeper into the specific types of bridges available, their diverse functionalities, and the exciting potential they hold for revolutionizing the financial landscape.

Read Also: Blaize’s article about how to launch a bridge on PolkaDot.

Types of Blockchain Bridges

The realm of blockchain bridges pulsates with diverse protocols, each with its unique strengths and characteristics. Understanding these distinctions empowers you to select the optimal bridge for your specific needs.

Chain-to-Chain Bridges

These workhorses facilitate asset transfers between specific pairs of blockchains, acting as dedicated corridors for movement. Their strengths lie in:

- Targeted Optimization: Tailored to address specific interoperability needs between two chains, often offering optimized fees and functionalities.

- Security Focus: Can implement specialized security measures and validation processes due to their narrow scope.

However, they also have limitations:

- Limited Connectivity: Restricted to the specific chains they connect, requiring users to potentially utilize multiple bridges for broader interoperability.

- Potential Centralization: Some chain-to-chain bridges rely on centralized entities for operation, introducing trust assumptions.

Real-life examples include:

- Rainbow Bridge: Connects Ethereum and Aurora with a decentralized infrastructure, enabling fast and secure NFT transfers.

- WBTC Bridge: Wraps Bitcoin as ERC-20 tokens on Ethereum, unlocking DeFi opportunities for Bitcoin holders with centralized custodianship.

- Polygon Bridge: Integrates Ethereum and Polygon, offering faster transactions and lower fees for Ethereum users through a permissioned validator set.

- HyperLiquid Gateway: Connects Arbitrum to HyperLiquid’s sovereign chain, facilitating interoperability within their DeFi ecosystem via a trustless design.

Multichain Bridges

These versatile players connect multiple blockchains simultaneously, acting as bustling interchain hubs. Their strengths include:

- Broader Connectivity: Enable asset transfers across a wider range of chains, offering greater flexibility for users seeking diverse opportunities.

- Network Effects: Benefit from increased liquidity and user activity as they connect more chains, potentially enhancing efficiency and reducing fees.

However, they also present challenges:

- Complexity: Managing interoperability across numerous chains can introduce technical complexities and potential security risks.

- Potential Bottlenecks: As transaction volume increases, certain multichain bridges might face scalability limitations.

Real-life examples include:

- Synapse: Enables seamless asset transfers across various chains like Ethereum, Avalanche, and Fantom, utilizing a decentralized network of validators.

- Symbiosis: Facilitates interoperability between diverse Layer 1 and Layer 2 solutions with a focus on Cosmos-based chains, employing a hybrid trusted/trustless model.

Cross-Chain Messaging/Liquidity Layer

These advanced solutions provide a robust infrastructure for interchain communication and asset transfer, acting as the underlying fabric of interoperability. Their strengths include:

- Advanced Functionality: Go beyond simple asset transfers, enabling complex cross-chain interactions and communication between dApps.

- Scalability and Security: Often built with scalability and security in mind, offering high-throughput capabilities and robust security mechanisms.

However, they also come with considerations:

- Technical Complexity: Their advanced nature can make them less user-friendly for beginners or those unfamiliar with the technical underpinnings.

- Emerging Landscape: This is a rapidly evolving space, with new solutions and protocols emerging frequently.

Real-life examples include:

- Wormhole: Enables high-speed token transfers and cross-chain communication with its innovative tokenized message format, utilizing a network of guardians for security.

- Axelar: Facilitates secure and reliable communication between diverse blockchain ecosystems through a decentralized network of validators with a focus on general message passing.

- LayerZero: Offers ultra-fast cross-chain transactions and messaging capabilities through its novel Oracle network and optimistic rollup technology.

Beyond these categories, bridges can also be classified as:

- Trusted: These bridges rely on a centralized entity to oversee the transfer and management of assets across networks, offering a level of control and oversight in the bridging process. Trusted bridges operate similarly, employing centralized entities to manage asset transfers between chains. These entities, often corporations or consortiums, act as guardians, ensuring the validity and security of cross-chain transactions.

- Trustless: Trustless bridges operate on a decentralized model, eliminating the need for a central intermediary. These bridges offer increased security and decentralization, though they are not devoid of risks. For those seeking the ultimate in autonomy, trustless bridges beckon like open harbors. These bridges empower users to control their own assets without relying on any central authority. Sophisticated smart contracts govern bridge operations, ensuring tamper-proof security and verifiable transaction execution.

The choice between a trusted and trustless bridge depends on individual needs and risk tolerance. For those prioritizing ease of use and speed, trusted bridges may be suitable. But for those seeking ultimate control and decentralization, trustless bridges offer a powerful alternative. Ultimately, understanding the diverse forms of blockchain bridges empowers users to navigate the interoperable future with confidence, maximizing the potential of their crypto assets.

Choosing the right bridge hinges on your specific needs. Consider factors like supported chains, security model, transaction speed, and desired level of decentralization when making your selection. By understanding the diverse landscape of bridges and their unique characteristics, you can navigate the interoperable future with confidence and unlock the limitless potential of the blockchain ecosystem.

Recommendations for Using Blockchain Bridges

Selecting and integrating a blockchain bridge requires careful consideration of various factors, including security, compatibility, and the specific needs of the blockchain application.

1. Assess Your Needs:

- Centralization vs. Decentralization: Prioritize ease of use and familiarity with a trusted bridge operator, or prioritize self-custody and trustless protocols?

- Supported Chains: Does the bridge connect the specific blockchains you require?

- Supported Assets: Not all bridges accommodate every asset. Verify that the bridge supports the specific tokens or NFTs you intend to transfer. Some bridges even restrict functionalities like self-transfers, so ensure alignment with your intended use case.

- Routing: The seemingly direct path between two chains might not always be your most efficient option. Bridges often employ intricate routing mechanisms, potentially involving intermediary chains.

- Liquidity and Fees: Are liquidity pools deep enough to facilitate large transactions without significant slippage? Can you tolerate the transaction fees involved?

- Security and Audits: Has the bridge undergone thorough security audits? Does it utilize robust smart contract technology and minimize single points of failure?

2. Research the Bridge:

- Technical Design: Understand the protocol’s underlying mechanisms, including its trust model, consensus algorithm, and liquidity pool dynamics.

- Track Record and Community: Assess the bridge’s historical performance, user reviews, and the activity of its developer community.

- Supported Tools and Integrations: Does the bridge offer convenient integrations with DeFi protocols, wallets, or dApps you regularly use?

3. Integrating Bridges into Your Workflow:

- Begin with Small: Begin with smaller transactions to familiarize yourself with the bridge’s interface and functionality before committing larger amounts.

- Double-check addresses: Always verify the target wallet address and network compatibility before initiating a transaction.

- Monitor Transactions: Track your bridge transactions on-chain, utilizing blockchain explorers for additional validation and peace of mind.

The blockchain bridge landscape is ever-evolving. Keep yourself updated on the latest protocols, security developments, and emerging best practices. By following these recommendations and maintaining a keen eye on the evolving bridge ecosystem, you can confidently navigate the interoperable future, reaping the full potential of your blockchain assets.

Ensuring Security

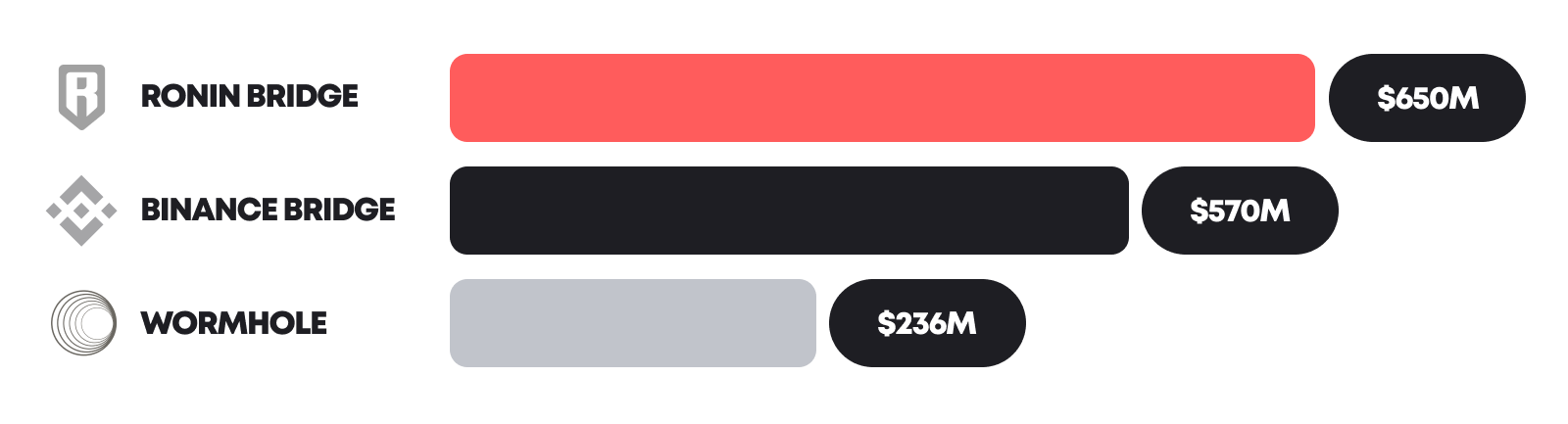

Blockchain bridges hold the keys to unlocking boundless possibilities. Yet, with immense power comes the specter of immense vulnerability. Their very essence – the movement of vast sums across disparate chains – transforms them into tempting honeypots for malicious actors. History bears witness to this reality:

- the Ronin Bridge attack ($650M stolen)

- the Binance Bridge drain ($570M lost)

- the Wormhole exploit ($236M vanished)

In this environment of heightened risk, unwavering vigilance and uncompromising security measures become non-negotiable imperatives. The potential consequences of a breach transcend mere financial losses; reputational ruin and a shattered sense of trust within the broader ecosystem loom large. Bridges, therefore, must stand as fortresses, meticulously fortifying their defenses against the relentless onslaught of cyber threats.

This section delves into the critical security considerations for blockchain bridges, exploring the intricate strategies and unwavering vigilance required to safeguard the very foundations of interoperable finance. By understanding the potential vulnerabilities and the essential safeguards, we can collectively strive towards a future, fostering innovation in finances.

Let’s explore some key ways to fortify the bridge landscape:

1. Smart Software Design:

Centralization as well as decentralization face vulnerabilities – centralized bridges can have single points of failure if key management or governance is flawed, while decentralized bridges often rely on relays or oracles that, if compromised, could disrupt operations.

The true key lies in impeccable software design. Eliminate single points of failure regardless of the governance model, be it through multisig wallets, secure key storage, and distributed governance in centralized bridges, or robust oracle networks and fault-tolerant relay infrastructure in decentralized ones.

Remember, security stems not from the system’s structure, but from its meticulous and vulnerability-free design.

2. Bandwidth Management:

To guarantee a smooth user experience and prevent congestion, bridges must tackle scalability and high availability. This means efficient bandwidth management, regular DDoS vulnerability assessments, guaranteeing constant availability of relay/validation services, and implementing robust failover procedures for validator failures. By addressing these elements, bridges become resilient arteries, handling increasing demand while ensuring uninterrupted cross-chain activity.

3. Smart Contract Audits:

The bedrock of any bridge’s security lies in its meticulously crafted smart contracts. Engaging reputable auditing firms to conduct thorough vulnerability assessments is crucial. Look for bridges like Ren, which have undergone multiple audits by esteemed crypto security experts, providing users with enhanced confidence in the code’s integrity.

Read more about Blaize expertise in smart contracts auditing services.

4. Incentivizing Responsible Behavior:

Encouraging ethical behavior within the bridge ecosystem is vital. Implementing mechanisms like bug bounties to reward the discovery and responsible disclosure of vulnerabilities fosters a collaborative security culture. Furthermore, utilizing advanced monitoring tools and real-time analytics allows for timely detection and mitigation of potential threats.

5. User Education and Vigilance:

The user remains the final bastion of defense. Promoting educational resources and best practices for secure bridge usage is vital. Educating users about verifying addresses, double-checking transaction details, and opting for trusted bridge operators empowers them to navigate the interoperable landscape with awareness and caution.

6. Cross-Chain Collaboration and Innovation:

The battle for blockchain security is best fought collectively. Encouraging collaboration and communication between bridge developers, security researchers, and blockchain communities fosters knowledge sharing and the development of robust cross-chain security solutions. Moreover, supporting and funding innovative research initiatives focused on novel trustless protocols and cryptographic mechanisms can pave the way for a more secure future of interoperability.

By embracing these best practices and fostering a culture of security throughout the ecosystem, we can ensure that blockchain bridges not only unlock the boundless potential of interoperability but do so in a safe and reliable manner. Remember, the security of this interchain future rests upon the shoulders of both developers and users alike. By working together, we can navigate the exciting world of cross-chain finance with confidence and pave the way for a truly secure and decentralized future.

Blaize Expertise in the Domain of Bridges

At Blaize, we understand that the world of blockchain is as diverse as it is complex, especially when it comes to the critical domain of blockchain bridges. Our expertise in this field ranges from conducting comprehensive security audits of existing bridges to developing custom-designed bridges tailored to our clients’ specific needs and requirements.

Our deep understanding of blockchain technology and our commitment to security and efficiency enable us to offer solutions that not only bridge gaps between different blockchain ecosystems but also ensure the highest standards of safety and functionality. Whether it’s enhancing the security of a multi-faceted bridge or creating a bespoke solution for seamless asset transfers, Blaize stands at the forefront of innovation in blockchain interoperability.

Our case studies reflect our versatile approach and our relentless pursuit of excellence in connecting the blockchain world.

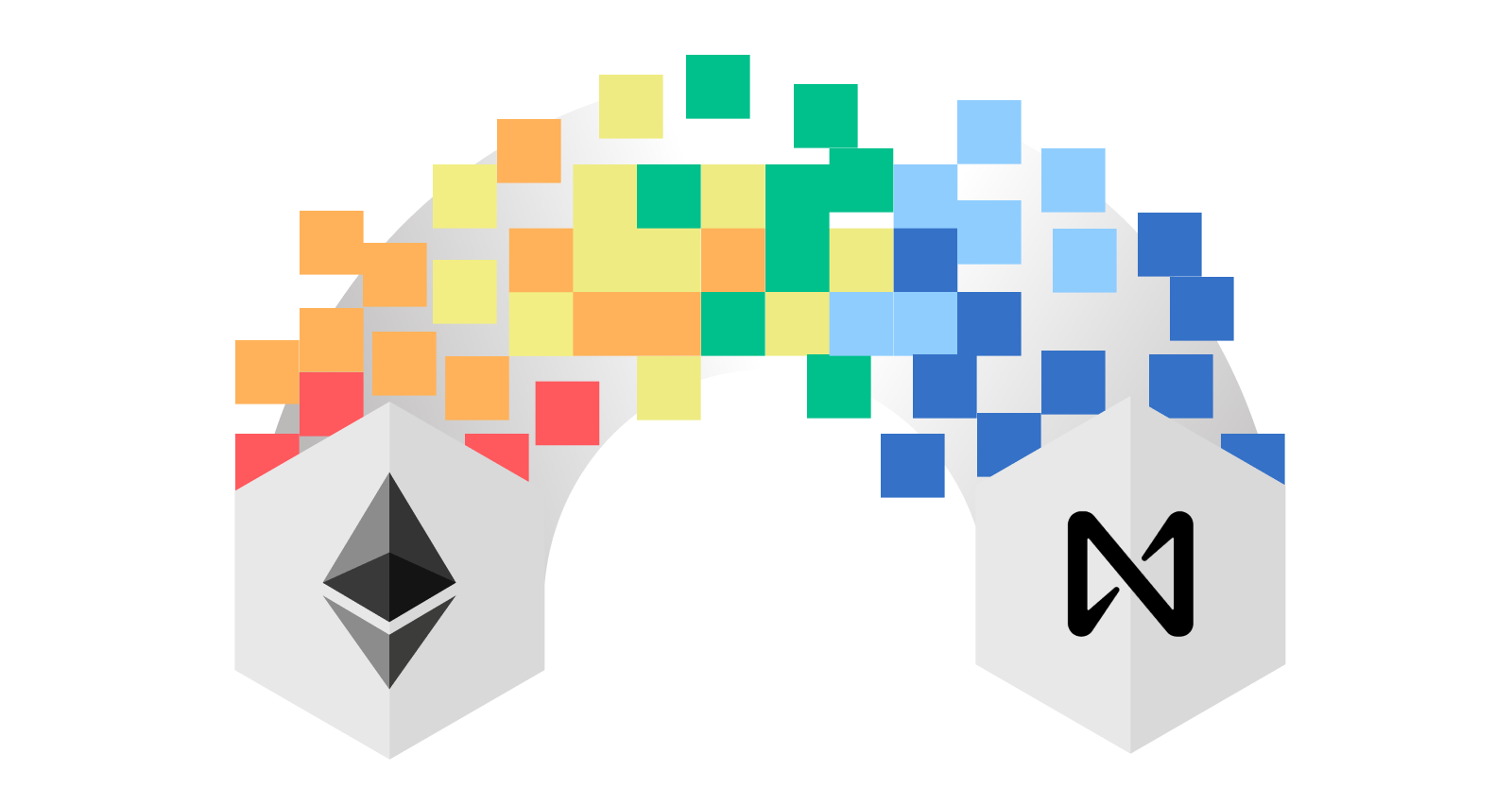

Smart Contract Security Audit for Rainbow Bridge by Aurora

Overview: Blaize was approached by Aurora for a comprehensive security audit of their Rainbow Bridge, a vital component facilitating asset transfers between NEAR and Ethereum blockchains. This project’s complexity demanded a meticulous approach to ensure the robustness and security of the bridge.

Challenge: The task was to scrutinize the smart contracts relayers and other additional services of Rainbow Bridge for potential vulnerabilities. So the main challenge was in multi-components. Given the bridge’s critical role in asset transfer, any security lapse could lead to significant financial and reputational damage. As well, within this project a combined team of experts from Blaize and Aurora was involved.

Solution: Blaize’s team of expert auditors conducted a thorough analysis of the smart contracts. They employed advanced tools and techniques to identify and address security vulnerabilities, ensuring compliance with best practices in blockchain security.

Outcome: The audit was successful, leading to the enhancement of the Rainbow Bridge’s security architecture. Blaize’s intervention fortified the bridge against potential attacks, instilling confidence in its users and stakeholders.

Read more about Rainbow Bridge case by Blaize here.

Smart Contract Security Audit for BlueLight Kale Bridge

Overview: BlueLight sought Blaize’s expertise for a security audit of their Kale Bridge, a blockchain bridge designed to enable seamless asset transfers across multiple blockchains.

Challenge: The major hurdle was to ensure the impenetrability of the Kale Bridge against a wide array of threats. The bridge’s modular functionality and integration with various blockchains amplified the need for a comprehensive security strategy.

Solution: Blaize deployed its seasoned team to conduct an exhaustive audit of the bridge’s smart contracts. The team’s complex multi-step auditing strategy with cross-verifications between auditors to uncover any security flaws, ensuring the bridge operated with the highest security standards.

Outcome: The thorough audit resulted in the identification and rectification of several critical security issues. Blaize’s contribution significantly elevated the security profile of the Kale Bridge, making it a reliable and secure platform for asset transfers.

Read more about BlueLight Kale Bridge case by Blaize here.

Atomic Swap Bridge Development for REMME Chain

Overview: REMME Chain engaged Blaize to develop an atomic swap bridge, a decentralized solution for exchanging assets across different blockchains without intermediaries.

Challenge: The task was challenging due to the technical complexity involved in creating a decentralized, trustless system for asset exchange. The bridge needed to be efficient, secure, and user-friendly to gain widespread adoption.

Solution: Blaize took on this challenge by leveraging its deep expertise in blockchain technology. The team developed a robust atomic swap bridge with an intuitive interface, ensuring seamless and secure transactions across blockchains.

Outcome: The successful development of the atomic swap bridge for REMME Chain marked a significant milestone. It enabled users to conduct cross-chain transactions securely and efficiently, enhancing the utility and reach of the REMME ecosystem.

Read more about REMME Chain by Blaize here.

Conclusion

Bridges stand as a cornerstone in the realm of blockchain interoperability. Their ability to connect disparate networks not only enhances functionality but also paves the way for a more integrated and efficient blockchain ecosystem. As the web3landscape continues to mature, the role of bridges in enabling this interconnected future becomes increasingly indispensable.

The journey of blockchain bridges has been transformative. They began as simple connectors, facilitating the movement of individual assets across isolated chains. Wrapped tokens like WBTC and RenBTC unlocked DeFi opportunities for established assets like Bitcoin. Bridges then evolved into value transfer hubs, enabling seamless movement of funds across diverse ecosystems. Multichain bridges like Synapse empowered users to navigate a plethora of chains, maximizing returns and exploring innovative dApps.

Today, bridges are poised to usher in a new era: the dawn of interoperable layers. They transcend mere value transfer, facilitating the movement of information and enabling complex cross-chain interactions. This paves the way for a future where dApps built on different chains can communicate seamlessly, composable DeFi protocols unlock unprecedented financial possibilities, and the true potential of blockchain’s interconnectedness is unleashed.

The interoperable future promises a landscape where innovation flourishes, user experiences are enhanced, and the boundaries between individual chains dissolve. As we venture further into this interoperable frontier, let us remember the crucial role bridges play in fostering a more inclusive, efficient, and dynamic blockchain revolution.

Contact Blaize to explore the opportunities of blockchain bridges right for your business!

Frequently Asked Questions

What is a Blockchain Bridge?

A blockchain bridge is an essential technology in the world of digital assets, serving as a connection between different blockchain networks. It allows for the transfer and sharing of information, assets, and smart contracts across various blockchain ecosystems. This enables isolated blockchains to communicate with each other, thereby overcoming their inherent limitations and enhancing the interoperability of the blockchain space.

How Does a Blockchain Bridge Work?

A blockchain bridge operates by either using a Wrapped Asset Method or a Liquidity Pool Method. The Wrapped Asset Method involves representing an asset from one blockchain as a token on another blockchain, maintaining its original value. This token can then be transferred across the bridge and ‘unwrapped’ back into the original asset. The Liquidity Pool Method, on the other hand, uses pools of assets where users deposit their assets on one blockchain and receive an equivalent value on another. This method ensures liquidity and facilitates the smooth transfer of assets across different networks.

Are Blockchain Bridges Secure?

The security of blockchain bridges varies based on their design and implementation. While trustless bridges offer increased security through decentralized control, reducing the reliance on a single entity, they are not completely risk-free. Trusted bridges, controlled by centralized parties, provide a different security model with their own set of risks and benefits. Ensuring security in blockchain bridges involves auditing, continuous monitoring, and the implementation of security protocols to mitigate potential vulnerabilities.

Why Use a Blockchain Bridge Instead of a Centralized Exchange?

Using a blockchain bridge instead of a centralized exchange offers several advantages. Bridges enable direct, peer-to-peer transactions between different blockchains, reducing reliance on central intermediaries. This enhances the autonomy and privacy of users. They also support a wider range of tokens and assets.

What Are Some Popular Blockchain Bridges?

Several popular blockchain bridges have gained prominence in the crypto community, each offering unique features and capabilities. These include bridges like Stargate, Across, and Celer cBridge. These multi-chain platforms enable the transfer of assets like cryptocurrency and tokens between major blockchains.