How to Launch a DeFi Project?

The DeFi landscape is undergoing explosive growth, with the total value locked in DeFi protocols surpassing $57 billion as of January 2024. This rapid expansion presents a perfect opportunity for innovators and entrepreneurs seeking to reimagine financial infrastructure. However, navigating this complex domain requires careful consideration of technical, strategic, and market factors.

Main points you need to know for Developing a Successful DeFi project:

- Project Development Speed

- Integration with another DeFis

- Business Logic Analysis

- Experienced DeFi Developers

In the first part of this guide, we’ll explore the high-level overview of the DeFi project creation process, offering a clear roadmap from conceptualization to realization.

The second part delves into the details and practical experience gathered by Blaize’s specialists. Whether you’re steering your project from a business perspective or diving into the technical depths, this article will illuminate the key elements and potential challenges at each stage of your DeFi venture. Let’s delve into the essential knowledge and strategies needed to craft a DeFi protocol that stands out in the modern financial ecosystem.

STEPS TO BUILD A DEFI PROTOCOL

Building a successful DeFi protocol depends on ensuring a lot of essential points are strictly maintained.

You possess a groundbreaking idea within the DeFi landscape with billion-dollar potential. Having meticulously conducted market analysis, you’ve identified a specific niche, carefully evaluated competitors, and formulated a potent value proposition. Now, the journey from vision to tangible form commences. The next thing you need is an experienced web3 development company like Blaize.

Here, we delve into the initial steps to transform your vision into a successful DeFi protocol:

Step 1. Protocol Architecture and Security:

- Define Protocol Architecture: Architect the core logic of your application, meticulously outlining the smart contracts that will govern its operation, as well as funding mechanisms, token utility, profit models for users and protocol, core functionality, etc.

- Security Prioritization: Implement robust security measures throughout the development process, employing security audits, and secure development practices to avoid vulnerabilities.

Step 2. Development and Testing:

- Agile Development Methodology: Adopt an agile development approach to facilitate iterative iterations and continuous improvement, ensuring responsiveness to market feedback and changes in the DeFi landscape.

- Modular Design and Unit Testing: Design your application’s components with modularity in mind, enabling independent unit testing and simplified debugging throughout the development cycle.

- Comprehensive Test Suite: Implement a rigorous and multi-layered test suite encompassing functional testing, security audits, stress testing, and load testing to guarantee the stability and reliability of your application.

Step 3. Ongoing Optimization and Monitoring:

- Data-Driven Decision Making: Continuously monitor your application’s performance and user behavior, leveraging data analytics to identify areas for improvement and optimize key parameters such as tokenomics and incentivization structures.

- Adaptability and Evolution: Remain agile and responsive to the dynamic nature of the DeFi landscape, adapting your application and roadmap in response to emerging trends, regulatory changes, and user feedback.

- Security Maintenance: Implement ongoing security monitoring and update your security measures proactively to address any potential vulnerabilities that may arise over time.

Blaize has extensive and deep expertise in security auditing services which are crucial for any DeFi project to ensure trust and reliability. Read more about it here.

By meticulously following these steps and remaining committed to ongoing optimization and adaptation, you can increase your chances of crafting a project that stands the test of time and thrives within the ever-evolving DeFi ecosystem.

DeFi Project Development Speed

We understand that the DeFi market is developing lightning-fast and one of the main goals is to deliver a revolutionary or better solution in a relatively short period of time.

IN AN AVERAGE ESTIMATION, 2.5 MONTHS IS AN OPTIMAL DURATION TIME FOR DEFI PROJECT DEVELOPMENT.

It is very important to split this time wisely into three fundamental parts:

- Planning

- Development

- Testing

Surprisingly, the main time should be dedicated to the first and third phases, so project architecture planning and project testing accordingly. We will talk about the importance of those two in the next parts of this article.

Integration with another DeFis

While established protocols like Compound, Balancer, and Aave represent a judicious approach necessitates the evaluation and integration of diverse protocols aligned with your project’s unique objectives. Here, we delve into an assortment of potential integrations:

- Decentralized Exchanges: Integrate with a multiplicity of DEXes, each offering distinct advantages in terms of liquidity depth, tradable token pairings, and execution mechanisms. This caters to the variegated preferences and trading strategies of your user base.

- Lending Protocols: Leverage the established lending platforms of Compound, Aave, or their peers to furnish users with loan options for augmenting liquidity or supplying liquidity to accrue interest.

- Cross-Chain Interoperability: Bridges such as Axelar, LayerZero, and Wormhole facilitate seamless asset movement across disparate blockchains, thereby expanding your project’s reach and user base.

- Liquid Staking: Integrate with Liquid Staking protocols such as Everstake to empower users to garner staking rewards while preserving token liquidity.

- Multisigs and Smart Contracts: Securely manage your project’s treasury and operations through robust solutions like Gnosis Safe multisigs, guaranteeing transparency and fostering community trust.

While proficiency in technical intricacies remains paramount for successful integration, a strategic vision is of equal importance. Meticulously assess each protocol’s compatibility with your project’s objectives, alignment with the community, and long-term sustainability.

By meticulously adopting a strategic approach to DeFi integrations, you can achieve:

- Enhanced Functionality

- Augmented Liquidity

- Innovative Strategies

- Community Expansion

Usually, initial integration should start from cooperating with market giants like Compound, Balancer, or Aave. However, this step requires a lot of research before the code writing.

All these protocols have significantly different interfaces and features that might be crucial for integration. That’s why your developers should have deep experience not only in code creation but in code reading too.

The task of uniting entries to several DeFi protocols under the unified interface of your own app is not very comprehensive and requires sometimes unique solutions. Nevertheless, in spite of the high difficulty, it brings flexibility, since you will be able to create new DeFi strategies and switch between them. Thus, your protocol will bring more profit.

Need a skilled and experienced team to integrate your project with another DeFis? We are here to help you with that!

The other thing to consider is the development of such significant projects as the Polkadot ecosystem (or other interoperable protocols) and different parachains within it. So if you want to integrate your projects with Polkadot or Cosmos, it is better to think of bridge development in advance and include it at the planning phase.

Successful DeFi projects don’t merely exist – they actively engage in collaboration and contribute to the interconnectedness of the ecosystem. By strategically integrating with complementary protocols, you can unlock the full potential of your project and contribute to the burgeoning of a vibrant DeFi landscape.

Business analysis

On our way we have seen numerous brilliant ideas that have gone into dust. It was really interesting and somehow even “working” ideas with initial capital.

IN TERMS OF BUILDING A DEFI PROJECT, BUSINESS ANALYSIS OF YOUR IDEA IS A CRUCIAL THING TO DO.

That is why, many projects fall not because they are scammy or have a weak tech stack, yet just due to a lack of thoughtful analysis from the business perspective.

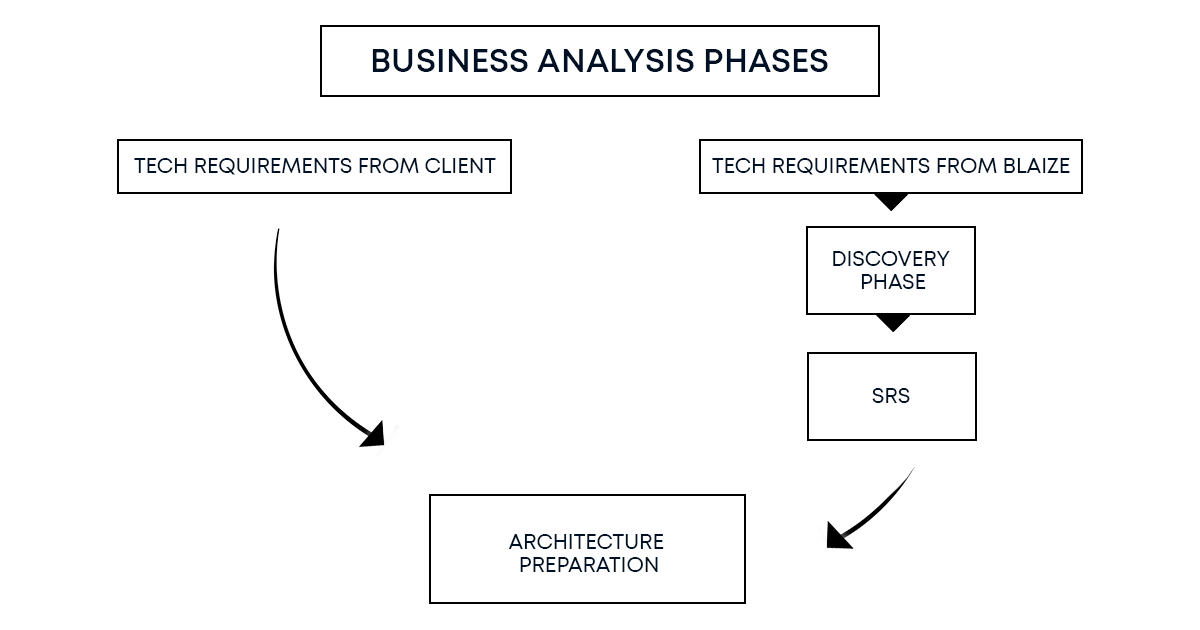

In Blaize, we have a strictly structured and tuned process of project assessment from the business perspective.

Firstly, we gather the main technical requirements for the project. If the client came just with the idea, we kindly write a tech requirement documentation.

If you are building a DeFi protocol, during the discovery phase, we take into consideration product perspectives as well as product main features to adjust the best operating environment. After the discovery phase, Blaize analytics create a Software Requirement Specification (SRS) document and deliver this to the client.

REMEMBER TO NOT START ARCHITECTURE PREPARATION WITHOUT CAREFULLY PREPARED SRS WITH A FULL SET OF REQUIREMENTS.

Your DeFi protocol will thrive, if:

- it is a new & interesting solution on the decentralized market

- it is more cost-efficient then other DeFis

The description and implementation of those features should be carefully studied and defined in the SRS of your project. Make sure your business analysis contains those! Otherwise, building DeFi protocols may turn out to be a failure for you.

Team of Experienced DeFi Developers

The DeFi project requires a wide scope of skills and broadened knowledge of both spheres – finance and blockchain technology. That is why an experienced team of developers is a must-have for creating a decentralized finance project.

Read more on how to choose a blockchain development company in our thorough guideline.

In this part, we want to concentrate on the main obstacles our programmers faced during the development phase of DeFi protocols and help you to prevent those in your project.

Those are the main points to take into account during development:

Smart Contracts Development

Smart contracts are the basic skeleton of any DeFi project. Without this, creating a DeFi protocol is impossible. In open finance, they often represent complex and long codes, with broad protocol functionality encrypted.

First of all, a smart contract has to include all possible steps and actions the user can make. At the same time, everything should be transparent and secure which also adds additional complexity to the initial contract. The next thing is the reliability of the contract, as long as it deals with huge numbers of dollars, it has to be properly secured from hacking attacks. We have repeatedly solved such problems as part of the provision of smart contract development services.

As we said before, developing a DeFi startup nowadays requires integration with other existing DeFis. So, the thing, in this case, is the complexity of other protocols you want to integrate with. Under these circumstances, engineers need to analyze and study this code carefully to ensure a reliable and safe integration. Otherwise, the money can be stolen or locked in a smart contract while swiping between two or more protocols.

That all contributes to difficulties in development and requires an experienced team of programmers specializing in Solidity as a prior.

There are 5 main problems, engineers face while developing DeFi project:

The burgeoning landscape of Decentralized Finance (DeFi) presents unique and exciting opportunities, but it also poses a multitude of intricate challenges for developers. To navigate this complex terrain and bring groundbreaking DeFi projects to life, a deep understanding of these hurdles and strategic mitigation strategies is essential. Here, we delve into five key challenges that developers must navigate:

1. Unwavering Security at Every Stage

Security reigns supreme in DeFi, where even the smallest vulnerability can lead to catastrophic consequences. A multi-layered approach is paramount, starting with comprehensive pre-launch audits by renowned security firms. However, the journey doesn’t end there. Continuous post-deployment monitoring utilizing advanced security tools is vital to detect and address emerging threats promptly. Additionally, regular penetration testing simulating real-world attacks further bolsters the project’s defenses. Therefore a DeFi security audit is required.

Smart contract security audit is an important part of the contracts united work testing and detecting smart contract vulnerabilities BEFORE any hacked does so.

CONTACT BLAIZE IF YOU WANT TO GET A SMART CONTRACT SECURITY AUDIT ASAP!

2. A Modular Architecture for Adaptive Evolution

The DeFi landscape is inherently dynamic, with new trends and opportunities emerging at a rapid pace. Protocols that fail to adapt risk becoming obsolete and losing valuable liquidity. A modular architecture allows for agile integration of new features and income streams as the market evolves. This flexibility empowers developers to respond swiftly to shifting user demands and capitalize on novel opportunities.

3. Bridging the Interoperability Divide

Limiting a DeFi project to a single blockchain network significantly restricts its reach and potential. Cross-chain interoperability unlocks access to diverse user bases and liquidity pools across various ecosystems. While technical intricacies exist, embracing cross-chain solutions like bridges and atomic swaps expands the project’s horizons and fosters broader adoption.

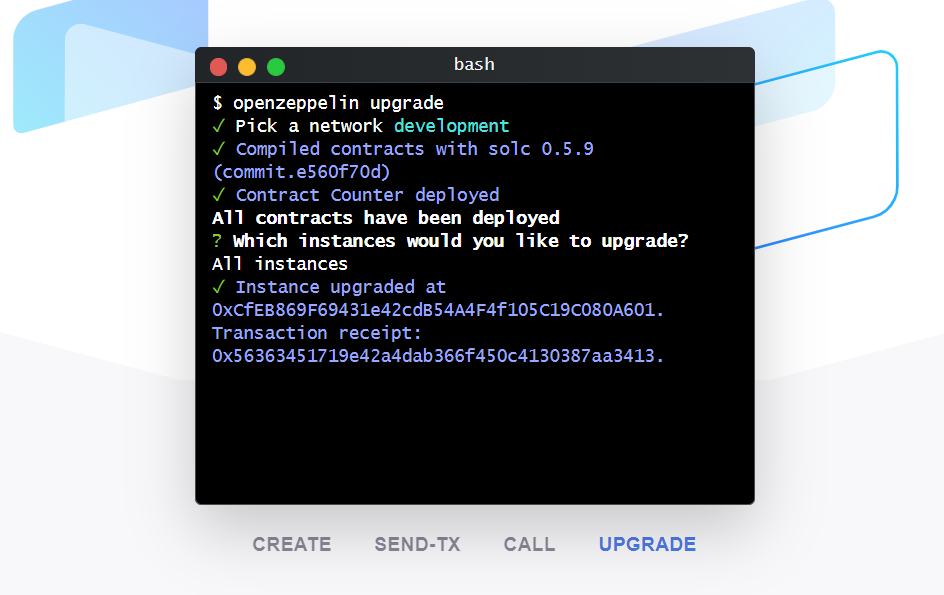

In Blaize, we always use OpenZeppelin SDK upgradable contracts possibilities.

Its variety of tools and unique features always help to upgrade smart contracts and make it more readable and visually attractive. Read: How to develop Python and Java SDKs

4. Balancing Decentralization and Control

Decentralization lies at the heart of DeFi, yet navigating its inherent complexities can be challenging. Striking a balance between community governance and developer control is crucial. While empowering users through transparent and inclusive governance mechanisms is essential, unchecked democratic processes can lead to slow decision-making and suboptimal development paths. Carefully designed governance models that harness the wisdom of the community while ensuring efficient decision-making are key.

The protocol needs to have its own governance token. One of the most important things regarding a token is its functionality. Functionality in this terms means it has to be used within the network and utilized by your community to be able to govern the protocol and get the rewards.

Read how we built DAO & governance token in snglsDAO use case

This will incentivize the users in both ways – first of all, monetization. Due to token utilization, its capitalization will grow, so “getting reward” in your governance token will lead to getting real money. Second of all, users will be able to use this token in DAO and, for instance, vote on protocol enhancements.

5. Building a Resilient Ecosystem

No DeFi project exists in isolation. While leveraging established protocols and aggregating liquidity can be advantageous, excessive dependence creates vulnerabilities. A diversified approach that mitigates reliance on any single external entity fosters resilience and protects against potential disruptions. Exploring alternative protocols and fostering organic liquidity growth are crucial aspects of ensuring long-term sustainability.

By meticulously addressing these challenges and harnessing the power of innovative solutions, developers can unlock the immense potential of DeFi and contribute to the construction of a robust, inclusive, and thriving decentralized financial ecosystem.

Project Testing

Unit tests and security audits are crucial for the proper work of your contracts. Yet, they are checking the formal logic and concentrating mainly on the smart contracts part of the project.

In order to check the work of the whole system, we recommend providing a full project system test. Therefore, in this part, we are going to share some tips on how to test your decentralized finance project properly.

While unit tests and security audits form the bedrock of reliable smart contracts, they only paint a partial picture. Assessing the holistic functionality of your entire DeFi project requires a more comprehensive approach: end-to-end testing.

Unit tests excel at verifying individual contract logic, while security audits identify potential vulnerabilities. However, they often lack the ability to evaluate how these components interact within the broader system. End-to-end testing fills this crucial gap, ensuring seamless integration and frictionless user experience across all project elements.

Before venturing onto the mainnet, thoroughly testing your project in a controlled environment is paramount. Local testing, utilizing tools like Ganache for creating a personal Ethereum network fork, offers several advantages:

- A private testing ground, independent of the live mainnet, minimizes risks and allows for controlled experimentation.

- Developers can freely manipulate addresses and configurations, facilitating comprehensive functionality testing.

- No real-world transaction fees incur, making it a cost-efficient testing framework.

The other way is to test your DeFi protocol on public testnets which are available and accessible by anyone. The only thing with those is that not all of the existing DeFi protocols are presented there.

While local testing provides a controlled sandbox, replicating real-world conditions for comprehensive testing necessitates venturing into the realm of public testnets. Popular options like Ropsten and Kovan offer valuable advantages.

Public testnets may not mirror the full spectrum of DeFi protocols present on the mainnet. This creates a gap where connections to critical functionality are absent.

To overcome this obstacle, developers can leverage stubs. These are lightweight mockups of missing DeFi protocols, replicating their interfaces and behaviors as closely as possible within the testnet environment. While not perfect substitutes, they effectively simulate real-world interactions and enable comprehensive testing.

The ideal testnet setup goes beyond individual stubs. Aim to replicate the actual user experience as closely as possible:

- Prepare a Beta-like Environment: Set up the testnet to closely resemble your intended mainnet deployment in terms of configuration, resources, and network conditions. This fosters a realistic testing environment for user interactions.

- Stress Test Performance: Simulate peak user loads and unexpected scenarios to assess your project’s ability to handle real-world challenges.

- Integrate Real-World Data: If possible, introduce data feeds and mock oracles mirroring actual market conditions for an even more realistic testing experience.

Remember, a well-prepared testnet acts as a crucial bridge between development and a successful mainnet launch. By investing in a comprehensive testbed, you ensure your DeFi project is thoroughly vetted, robust, and ready to thrive in the real world.

ANYWAY, LOCALLY OR ON THE TESTNET, YOUR PROJECT HAS TO BE TESTED IN CONDITIONS CLOSE TO REAL. NO TESTING ON PRODUCTION.

NOT ONLY SMART CONTRACTS

The contemporary DeFi landscape extends far beyond smart contracts. A robust, multifaceted ecosystem underpins seamless user experience and project success.

The essential components of a successful and reliable DeFi protocol include:

- Intuitive User Interfaces: Seamless integration with cutting-edge wallets fosters a frictionless user interaction.

- Data-Driven Insights: Backend infrastructure and subgraph integration meticulously aggregate user data and on-chain information for insightful visualizations.

- Streamlined Automated Workflows: Efficiently execute routine tasks through automation, enhancing operational efficiency.

- Reliable Price Feeds: Leverage trustworthy oracles and price feeds to guarantee accurate data for informed decisions.

- Scalable Infrastructure: We create a robust foundation that fosters your project’s growth and long-term sustainability.

Prioritizing user experience is paramount. We recommend emphasizing key user-centric metrics, such as APY. Prominently displaying this data, just like popular platforms like Uniswap, empowers users with instant comprehension of potential returns. However, remember that crafting a successful DeFi project necessitates a holistic approach, exceeding mere APY focus. By meticulously addressing the entire ecosystem and prioritizing user experience, you cultivate a truly compelling and enduring offering.

Conclusion

From this article, you already know how to build a DeFi protocol and understand that developing such an application requires deep expertise not only in blockchain technology but also in finance and business analysis spheres.

Running such a startup needs a complex approach from an outsourcing company that specializes in DeFi project development services. It is also a necessity to have a dedicated team of both frontend and backend developers to provide full project consulting & assessment at the initial stage.

In Blaize, we have dealt with a number of different DeFi protocols, so we do have the needed knowledge and experience. If you want to create a successful DeFi project, we are ready to assist you in crafting a solution that will fit your needs.

Frequently Asked Questions

How do I create a successful DeFi project?

When working on your DeFi project, you should consider several factors for it to be successful:

- High development speed

- Integration with other products and protocols

- Thought-through business logic

- Experienced blockchain developers

How long does it take to build a DeFi app?

The timeframe of the development process depends on several factors, including the complexity of the project, existing documentation, tech specs, and more.

If you’d like to find out how much it would take to make a specific app, contact our team, and let’s discuss the details.

How can I make sure that my existing project is built well and secure?

If you are not sure whether your product/protocol/smart contracts are developed according to industry best standards, you can get them audited by the team of professionals.

Overall, we recommend conducting at least two audits to ensure high security of your product. And if you are looking for an experienced team to take care of it, you can always count on Blaize experts.