WHAT TO EXPECT: Blaize Predictions of Blockchain Development Trends in 2021

The recent year has come with a lot of way out technologies. Drastic market changes along with worldwide pandemic opened up many new niches and have boosted the development of alternative technologies. Numerous tech approaches and upcoming blockchain solutions give ground for the future suggestions of blockchain trends in 2021.

In this review, we will analyze the significant events on the crypto market and tell how this will affect the blockchain development industry. We will also share some predictions about blockchain technology for 2021.

Promising Blockchains

The upcoming 2021 is bringing two huge and very notable players in the blockchain environment. The cross-chain ecosystem of Polkadot along with renewed scalable and powerful Ethereum will surely make an industry turnover.

Polkadot parachains revealing

With the aim of creating the most scalable and interoperable cross-chain environment, Polkadot is one of the leading market changers.

“Polkadot is a sharded blockchain, meaning it connects several chains together in a single network, allowing them to process transactions in parallel and exchange data between chains with security guarantees”.

Polkadot Litepaper

In order to connect or build your own blockchain within this ecosystem, one needs to link to Relay Chain which is a mother blockchain of Polkadot. Until now, the process of connecting the first 5 parachains slots is in a very active development stage. Those few are the small part out of 100 defined as the primary goal.

Blaize has been sharing reviews on Polkadot ecosystem specification and Polkadot multichain pros and cons of dApp development in those articles.

The biggest number of slots is expected to be added gradually during the next few years. In addition, a significant amount of projects previously deployed to Kusama testnet will start moving to the Polkadot original environment.

This alteration will have a great impact on the current market because the overwhelming majority of projects built on the Substrate (for example Social Network, MantraDAO, Acala, Halva, Edgeware, etc.) have the main purpose of joining the Polkadot.

You can also learn more by contacting our dApp development company.

In addition, a lot of DeFi projects are already waiting in the queue (starting with the Chainlink) to launch on the largest blockchain network, which has not had any analogs yet. This may result in a huge DeFi market migration from Ethereum to Polkadot.

Read how you can join such a prosperous community and launch your project on Polkadot!

Ethereum 2.0 Transition

The questions regarding Ethereum enhancement have been circling for a couple of years before. The main complaints and inconveniences were mainly due to slow transaction operation speed and the issue of scalability in general.

The very new and thorough idea of Ethereum evolution – Serenity – was presented on the Devcon4 by Vitalik Buterin in 2018. The Serenity adoption is planned for a gradual system’s update according to the following phases:

- Phase 0 – Beacon Chain adoption and integration of new Ethereum PoS (launched on the 1st Dec 2020);

- Phase 1 – will see the integration of PoS and shard chains (expected on the Q4 of 2021);

- Phase 1.5 – represents the full transition of Ethereum 1.0 to the Beacon chain as one of the shards (expected 2022);

- Phase 2 – will bring the whole Ethereum 2.0 functionality together and show smart contract execution by the very new eWASM (Ethereum-flavored Web Assembly) to the world (expected 2023).

The world has never seen a transition of such a big ecosystem therefore the occurrence of numerous doubts and uncertainties is quite normal.

As one of the biggest worries we can highlight the fact that Ethereum has never followed strict deadlines and the scalability of such an initiative gives this event additional complexity. Yet, worth noting, that the release of other shard-based blockchain guided by PoS consensus like Near gives the initiative additional scores to win.

Ethereum switch to the PoS consensus was frequently underlined as one of the main system’s updates. Along with the future implementation of sharding, this will significantly improve network operability speed and increase transactions’ throughput. That is why Ethereum transition will deservedly become one of the biggest blockchain trends in 2021.

Predictions of Blockchain Technology in DeFi

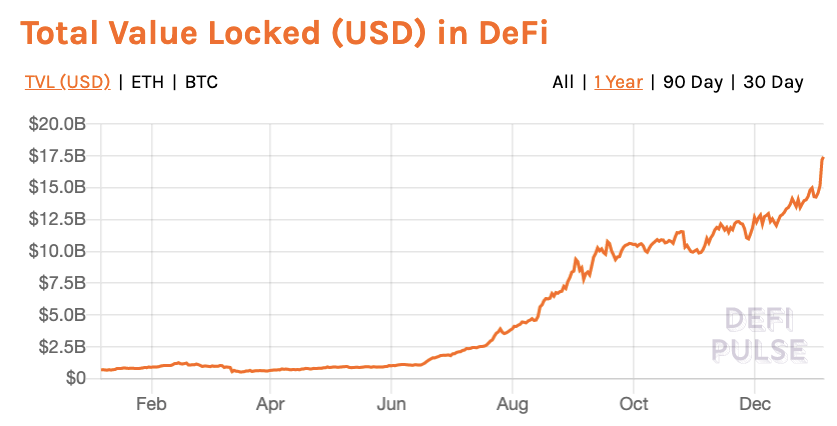

Decentralized finance TVL (total value locked) in 13.84B is beating its own record every week since the Q3 of the passing year. This gives a strong ground to think of the sector’s future growth and gathering of more power around cryptocurrencies.

The beginning of active development and adoption of advanced financial instruments as derivatives to decentralized finance also speaks about the future growth of DeFi potential. However, the occurrence of numerous recent issues regarding DeFi security has a real intensity to influence further elaboration.

DeFi Vampire Attacks

The open-source nature is the solid fundament of the whole web3. Yet, even the best cannot always serve as ideal and the wall has shown the cracks. It appears that the public accessibility the DeFi offers does not always act in goodwill and has resulted in numerous attacks on the protocol securities.

The core concept behind vampire attacks in defi lies in creating the same (or approximately the same) protocol, while adjusting a more profitable and attractive incentive mechanism to it.

We have shared more information and an overview of the biggest vampires in our article on How to Prevent Liquidity Attack in DeFi.

Some of the prominent and well-known projects like Curve, Compound, and Uniswap have already met their vampires in 2020, yet there are serious reasons to assert the tendency will continue in the upcoming 2021.

The introduction of the underlying protocol token is one of the heal-alls among interactive and user-friendly UI, implementation of DAO, branding strategy, and bug bounty. Different DeFi integration is the other important step in improving protocol reliability.

This blockchain technology trend will continue in 2021 and moreover, DeFi’s integration will overgrow protocols’ merger. The incorporation introduced by yEarn shall surely meet the equal competitor, so big hopes for another DeFi realm to be born. Read Also: How to Develop a Successful DeFi Project

Stablecoins

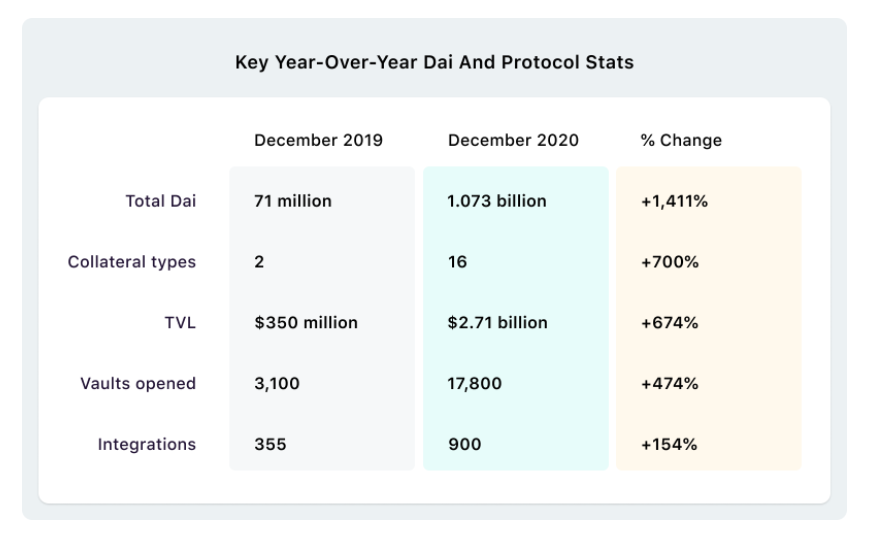

The enormously growing interest in stablecoins cannot remain overlooked as well as its growing TVL as the greatest evidence. As the biggest achievement, we can underline the gradual transition from centralized Tether to crypto-backed Dai.

Read also: How to Create a Stablecoin.

However Dai faces some issues during periods in which it breaks from its peg, Blaize team is very supportive of Dai’s growing power in 2021.

The will of keeping assets locked in crypto and turn to stablecoins underline technology relevance and necessity once again. Therefore, the upcoming year promises to strengthen the stablecoin position on the market, which might contribute to pursuing the introduction of legal regulation regarding this technology.

Read what has been done until now in the article about Stablecoin Adoption in Europe.

CEX Against DEX

2020 was very unkind to CEXes and its drop in March was the turning point. Consequently, many large investment groups have moved to DEXes or at least started to consider them seriously.

As a result, technology development solved the main problem with decentralized order books by an introduction of AMMs with the Uniswap ahead. We consider a huge liquidity migration from centralized exchanges to DEXes as one of the main blockchain predictions of 2021. Such a movement will have a positive impact on the cryptocurrency market, as long as the retail investors will also have the opportunity to influence the market prices.

DeFi summary

The creation of a decentralized financial market and DeFi startups is a great initiative that has a proven potential to stay and develop together with us in the upcoming 2021. However, such a wealthy market certainly attacks many unstable and scam protocols. We expect the gradual downfall of DeFi hype in the future year and therefore survival of the authentic, true projects.

“Many factors, and the pandemic, in particular, have had a big impact on today’s market. First, due to the continuous accumulation of large capitals, the market will be pumped and significantly oversaturated with liquidity. The next factor has resulted in an increased interest in cybersecurity and wireless transactions (primarily in online shopping and banking). It will also drive the growth of demand for decentralized applications that are able to provide a trustless environment.

Hence, the big boom for decentralized projects featuring the highest security can be expected as one of the blockchain trends. But it is worth noting that many scam projects that have been successfully settled in DeFi shall take a backseat, leaving the market for the leaders”.

Blockchain Software Development Trends

Based on the market research and previously mentioned changes the upcoming year might bring, Blaize’s team of experts can try to formulate the predictions of blockchain technology trends we are about to witness.

Read also: Blockchain in Healthcare

Rust language

Rust is a cutting-edge programming language that allows for building advanced algorithms in a more secure way with higher performance. It possesses a wide list of unique and very helpful features like a conditional compilation or moves semantics which creates a very developer-friendly environment.

Polkadot Relay Chain is built on Substrate framework with Rust language as well as one of the main Ethereum nodes – Parity. Therefore, the will of projects to connect to the multichain in the nearest future and further implementation of numerous advantages and protocol enhancements will push the demand for developers with great expertise in Rust programming language.

Additionally, such a need will not be supported by a single Polkadot release. Other events like Near blockchain release or Chainlink with its developed oracle system for Substrate based projects will influence demand for Rust developers. Check the whole list of teams building on Substrate here.

Vyper language

Vyper is an alternative language for a smart contract running and is the primary language for yEarn smart contracts. It is hosted by Brownie community-driven framework for smart contract development.

Despite the unconditional leadership of Solidity, recent yEarn strengthening on the market and becoming one of the biggest DeFi conglomerates might create a real market turnover.

All of the other DeFis that will wish to join the yEarn union will have to include Vyper to the list of must-known tools and therefore push the technology wider application. Read Also: Smart Contract Audits & How to Conduct Them

Blockchain Adoption on the Regular Basis

Technology adoption on a regular basis is one of the most promising blockchain trends in 2021. This year prepared a solid fundament for blockchain integration into everyday life activities with the introduction of such projects as Celo or Dharma.

“Engagement of non-crypto people to the market is one of the biggest perspectives for DeFi. In the coming year, there will be an increased amount of initiatives such as Dharma or other client applications that will make DeFi investing accessible via one-click”.

Celo Foundation

Celo is built with the aim to become a mobile-first blockchain platform. Celo blockchain is hosted by the Celo Foundation whose main aim is to simplify the usage of cryptocurrencies and make blockchain-based payments worldwide accessible.

The main focus of the Celo Foundation is turned to the developing world. One of the biggest advantages of the Celo blockchain is that the user is able to utilize his phone number as a public key in order to link to the network. Additionally, the system does not require an internet connection which makes it very convenient to use and widely accessible.

Read Also: Best Platforms for Blockchain Development.

Blaize team was honored to be a part of a Celo Foundation grant program and develop Python and Java SDKs for the framework. See the whole project overview in Celo use case.

Dharma dApp

Dharma creates a marketplace for lending and borrowing cryptos. The creation of Dharma app made a big step on the way to the global adoption of new blockchain technology.

Until Dharma, investment opportunities in crypto were available just for a few groups of people with a good knowledge of the technology. Yet, DeFi and crypto investment become easily accessible as soon as you connect the Dharma app to your bank account. The initiative is currently available in the US, but we shall expect worldwide expansion very soon.

Read Also: In-house vs. outsourcing blockchain development?

Final Thought

The passing year was quite favorable for the blockchain market and fruitful in terms of newborn initiatives and technologies. This helped to build a strong base for future projects to conquer the market.

Sergey Onyshchenko, Blaize CEO see the identity management in decentralized finance as one of the biggest opportunities for blockchain development in 2021:

“In the KYC market, there is an empty field for development opportunities. This is a very sensitive topic for decentralized exchanges, in particular, therefore sooner or later a big player will come here to offer a completely new approach to identity management.

Another important thing that’s coming is the tokenization of assets from the real business sector such as real estate or art. Such projects as Centrifuge have already begun development in this direction and offer the introduction of tokenized invoices which enable you to take out a loan on the security of such an invoice”.