Best Practices on How to Launch an ICO, STO, or IEO

In the ever-evolving landscape of cryptocurrency and blockchain, entrepreneurs and businesses continue to explore new ways to fund their ventures, and one of the most popular methods is to launch their own ICO. If you think that the ICO Epocha is long gone, you’ll be surprised to find out how many companies have launched ICOs since their “golden era.”

In 2021 alone, 136 projects raised over $1.3 trillion this way. Not bad, huh?

And now, in 2023, ICO, STO, and IEO fundraisings are still pretty common among blockchain projects. Moreover, we expect them to get even more popular as the recession period comes to an end.

That’s why today, we’ll share some tips and hints on choosing the most suitable type of fundraising for your product and conducting a successful launch.

Here at Blaize, we’ve been dealing with different blockchain projects for over 5 years, working on their tech stack development and consulting on the best solutions for enhanced protocol security and demand.

During this time, we’ve completed 70+ projects and deployed 400+ smart contracts for various platforms, including enterprise blockchain. Our customers include Aurora, Solana, 1inch, Celo, Everstake, and many other world-known companies.

We are sure that by the time you finish reading this article, you’ll have a much better understanding of how to launch an ICO, STO, and IEO and will be able to choose the best-fitting option for your project. Are you ready to start?

ICO, STO, IEO: Brief Overview

So what’s the difference between launching an ICO, IEO, or STO? Let’s consider IEO vs. ICO, and other types.

An ICO stands for Initial Coin Offering, the type of blockchain-based crowdfunding that was booming in 2016-2018. It was one of the first methods of fundraising that emerged in the crypto industry and quickly gained popularity.

Launching an ICO allows companies to raise capital for product development, while users can get early access to the project’s utility tokens, suggesting that they will rise in value.

An IEO, aka Initial Exchange Offering, is another type of fundraising that is managed by an exchange platform, unlike ICOs that are fully managed by the internal project team.

Due to their nature, IEOs are usually easier to access and trust by the general public.

An STO, or Security Token Offering, is a public sale of security tokens on a crypto exchange.

In contrast to ICOs and IEOs, which only offer utility tokens, STOs are specifically created for selling tokenized securities. Such a form of fundraising usually gains much more trust than any other crowdfunding and, thus, leads to better outcomes. However, it is significantly harder to launch, too, due to strict regulations volved in launching an STO requires the assistance of experienced crypto token developers.

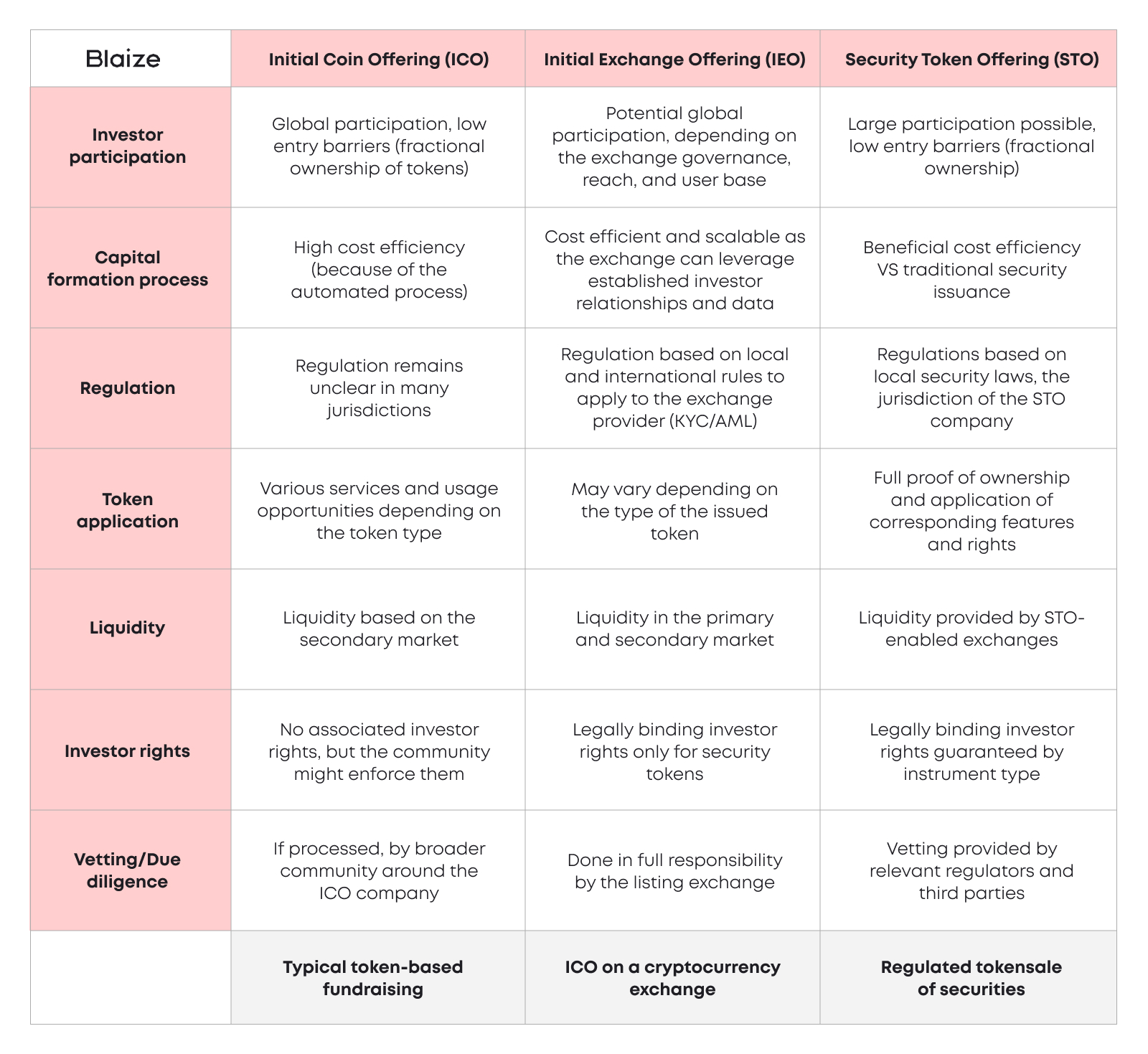

Here is a more elaborate table on the launch of an ICO, IEO, or STO for you to get a better grasp of all the differences.

| Initial Coin Offering (ICO) | Initial Exchange Offering (IEO) | Security Token Offering (STO) | |

| Investor participation | Global participation, low entry barriers (fractional ownership of tokens) | Potential global participation, depending on the exchange governance, reach, and user base | Large participation possible, low entry barriers (fractional ownership) |

| Capital formation process | High cost efficiency (because of the automated process) | Cost efficient and scalable as the exchange can leverage established investor relationships and data | Beneficial cost efficiency VS traditional security issuance |

| Regulation | Regulation remains unclear in many jurisdictions | Regulation based on local and international rules to apply to the exchange provider (KYC/AML) | Regulations based on local security laws, the jurisdiction of the STO company |

| Token application | Various services and usage opportunities depending on the token type | May vary depending on the type of the issued token | Full proof of ownership and application of corresponding features and rights |

| Liquidity | Liquidity based on the secondary market | Liquidity in the primary and secondary market | Liquidity provided by STO-enabled exchanges |

| Investor rights | No associated investor rights, but the community might enforce them | Legally binding investor rights only for security tokens | Legally binding investor rights guaranteed by instrument type |

| Vetting/Due diligence | If processed, by broader community around the ICO company | Done in full responsibility by the listing exchange | Vetting provided by relevant regulators and third parties |

| Typical token-based fundraising | ICO on a cryptocurrency exchange | Regulated tokensale of securities |

Find out our NFT development services

Similarities in ICO, STO, and IEO

Even though there are many differences between ICOs, IEOs, and STOs, they have many things in common, too.

Here are the main similarities in starting ICO, STO, or IEO:

- They require thorough preparation before the launch.

- The project (or the platform it is listed on) needs to have an existing community or create one from scratch to achieve the fundraising goal and succeed.

- The team has to prepare detailed documentation to present the project to the general public (Whitepaper is a must, Bluepaper and Onepager are optional).

- For better performance and outcomes, it is highly recommended to hire experienced advisors to the team.

Read Also: How to Build an NFT Platform

Benefits of an ICO, STO, and IEO

Launching an ICO, IEO, or STO can be pretty challenging, but it is definitely worth it if done correctly. We have gathered all the benefits of these types of fundraising so that you make a grounded choice and conduct a successful launch.

| ICO | STO | IEO |

| Easy to launch | Only accessible to properly authenticated investors | Already existing community of potential investors |

| Lower launching cost | Handle real assets and comply with government regulations | Traders in the exchange are already KYC/AML verified |

| Low entry threshold for participants | Offers high security, which makes it ideal for long-term investment | Easier to issue tokens compared to an ICO |

| Limited government intervention, fewer regulations | Better market acceptance than ICO and IEO | Immediate liquidity for projects after raising capital |

| The fundraising process is simpler when compared to STO and IEO | Less marketing budget required |

Of course, each method has certain loopholes and bottlenecks that you might need to face. That’s why we recommend hiring an experienced advisor long before you start an ICO, IEO, or STO.

Ideally, you should find an advisor as soon as you build the concept of your project and begin working on details. This way, you’ll save yourself a lot of time and prevent double work.

How to launch your ICO, IEO, or STO

So let’s say you have chosen the optimal fundraising method. What’s next? What exactly should you do to launch your ICO or another your own fundraising campaign and succeed?

Based on the Blaize team experience and industry best practices, we have compiled a short guide on launching successful blockchain-based crowdfunding, regardless of the selected type of campaign. We hope that following these steps will make the whole process easier for you and your team.

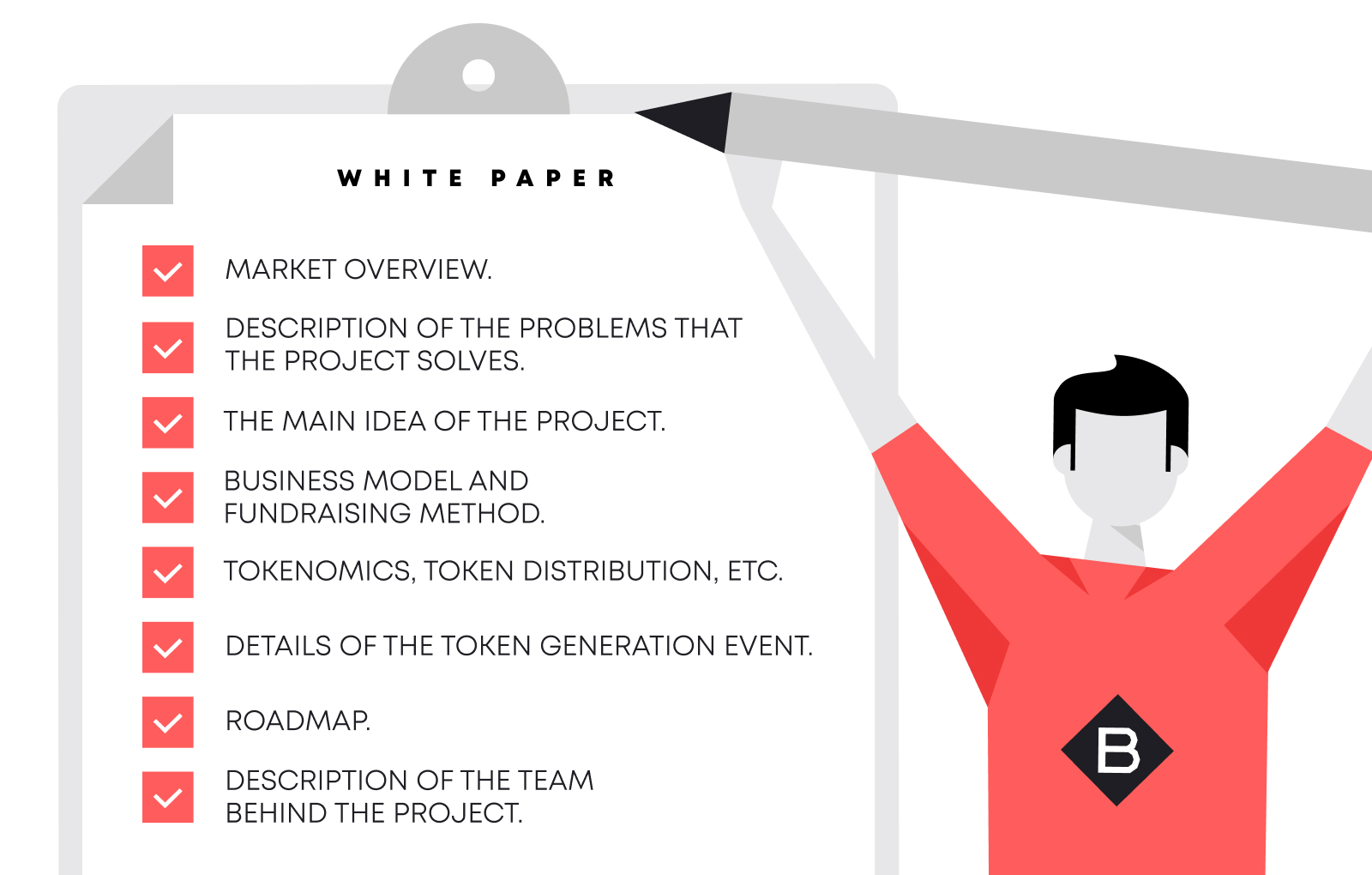

1. Whitepaper

As you have thought through the idea of your project, you should focus on creating an elaborate Whitepaper that would contain all the information about the business model, product tech stack, tokenomics, project development, and much more.

As we have mentioned before, a successful launch of an ICO is not a piece of cake in 2023, but a properly written Whitepaper can make it much easier.

Here is what a well-structured Whitepaper should contain:

- Market overview and a description of the existing problems that the project solves.

- The main idea of the project, its concept and mission.

- Business model and fundraising method.

- Tokenomics, including token implementation, its interaction with the product, token distribution, etc.

- Details of the token generation event.

- Roadmap and plans for further product development.

- Description of the team behind the project, their relevant experience, and links to social media (usually LinkedIn).

Make sure that your Whitepaper is well-structured, easy to understand, and provides all the necessary details for the investor to fully understand the idea of the project and fundraising. However, do not create an excessively long document – anything between 10-50 pages would do great.

2. Gather a reliable team

Building an experienced and trustworthy team is another essential step when launching an IEO, ICO, or STO. Make sure that the people you hire bring value to the project, have relevant experience, and, ideally, have gained a reputation in the blockchain industry.

To boost the credibility of your project, show the core team members on the project website and in the Whitepaper. And don’t forget to include the links to their personal profiles on LinkedIn or Twitter.

3. Find the right advisors

To launch your STO, ICO, or another fundraising campaign, you need advisors. They are as important as the core team members since they make a great impact on the project development throughout the whole journey. The trick is to find the right advisors long before the launch of an ICO, IEO, or STO. This way, you will get the most out of their expertise and will be able to get valuable advice from the very first steps of your project.

Usually, you can find advisors on blockchain-related conferences and events, through your network, and even on LinkedIn. Present the project and your traction to get their attention and discuss the possible ways of cooperation.

Similar to the team profiles, you should definitely add advisors to your landing page and the Whitepaper, especially if the team doesn’t have much experience.

4. Choose your fundraising strategy

Next, you should make up your mind on the fundraising strategy. Decide on launching an STO, ICO, or IEO based on your project specifications and preferences, and make sure to consult your advisors beforehand.

Besides, you should think through the fundraising process. How many investment rounds will you have? Are they gonna be private or public? If you choose to conduct at least one private round, which investment funds are you going to contact, and how will you present your project?

5. Create a marketing plan

Choose the most suitable platforms for promoting your project depending on the type of fundraising and create a marketing strategy.

When launching an IEO, the promotion of your project will be partially done by the exchange you choose as a launching platform. However, in the case of an ICO, full responsibility will fall on your shoulders.

We believe that the marketing campaign should cover all the stages of your project development, including pre-launch, launch, and post-launch. Remember that you are working on your brand in the first place, so your project name should be well-known regardless of the product development stage.

6. Prepare for the launch an ICO or another

Finally, as you have done all the preliminary work, it’s time to prepare for the launch.

This stage will fully depend on the type of fundraising you choose. For an ICO, you’ll need to launch your own platform. If you decide to have an IEO, you’ll have to contact various exchanges and choose the one that fits you best. In the case of an STO, the major part of the preparation will be connected with the legal area and the correct submission of the product and your tokens.

The launch itself is an extremely thrilling event, very emotional, and at times, disappointing. But if you follow the steps we’ve described above and have the right attitude, you have a high chance of success.

What happens after launching an ICO, IEO, or STO

The launch of an ICO, IEO, or STO is not the final step of your project development journey, though, and we are sure you understand it.

As you are done with the fundraising, the most interesting part begins – product development. This is the time to fulfill all the promises you made in the Whitepaper and during your pre-launch campaign to the investors and future users.

We highly recommend you maintain constant communication with your investors and create a community of project supporters at an early stage of project development. This way, it will be much easier to promote the product or new products of the ecosystem in the future.

You should also remember to move on with your marketing strategy and keep promoting the product, as it is an integral part of any post-launch campaign.

Read more: BUILDING FOR A STARTUP VS DEVELOPING FOR A BIG COMPANY

How to choose advisors for your ICO, IEO, or STO

Advisors are a vital part of any product team starting ICO, STO, or IEO campaigns. But how can you choose the right people for this kind of job?

As we have mentioned previously, you can find advisors in different places: blockchain events, conferences, summits, your network, LinkedIn, etc. To make sure that this is the expert you are looking for, make sure to check out their experience, research other projects they participated in, and see if you have the essential “connection” or “spark” to work together.

The Blaize team has extensive experience in assisting projects with different fundraising campaigns, so we’ll be happy to help you, too. Our specialists have expertise in different areas of getting ready for a launch, including the following:

- Preparing and validating Whitepapers and product structure.

- The technical part of fundraising preparation.

- Advising regarding blockchain technologies.

- Advising regarding the product development part.

To sum up the ICO vs STO vs IEO dilemma

If you have decided to launch your own fundraising campaign, choosing a suitable method is one of the first things to do. And even though ICOs, IEOs, and STOs have many things in common, they are still pretty different in terms of the preparation, the launch process, and communication with your target audience.

In case you need to recall the distinct features of these three types of fundraising, we’ve prepared a summary picture that you can download.

Launching an ICO, IEO, or STO is a complex and pretty challenging process that you shouldn’t go through alone. That is why we highly recommend working with experienced advisors who will be able to guide you through all the steps of this journey and lead to success.

The Blaize team has vast experience in assisting different blockchain projects to launch fundraising campaigns. We’ll be happy to help your team with product development, creating or validating a Whitepaper, advising on the blockchain or product part of the project, and much more. Reach out to find out the details and get a custom solution!

Frequently asked questions

Why are startups launching ICO, STO, and IEO to raise funds?

ICO, STO, and IEO are great ways to raise funds for product development. They allow the team to retain full control over the project while collecting funds by crowdfunding.

What makes a successful ICO?

There are many factors that help projects achieve their fundraising goal when launching an ICO, IEO, or STO. They include detailed and clear documentation, a profound technical part, compliance with all legal regulations, etc.

How to start ICO, STO, or IEO?

To launch successful fundraising, you should follow these steps:

- Create a well-structured, detailed Whitepaper.

- Gather a reliable team.

- Find the right advisors.

- Choose your fundraising strategy.

- Create a marketing plan.

- Make final preparations for the launch.

How to choose advisors for an ICO, IEO, or STO?

The right advisors for your fundraising campaign are more than just random people who have dealt with cryptocurrencies before. These should be reputable and reliable professionals who have profound knowledge and proven expertise in this area.

We recommend turning to advisors at the early stages of the project development. This way, you’ll be able to get the most out of these relationships.

How much does launching an ICO and IEO cost?

There are many factors that influence the final cost of launching a campaign. To name a few, these are the fundraising method, the new team members and advisors you need to hire, development services, and so on.